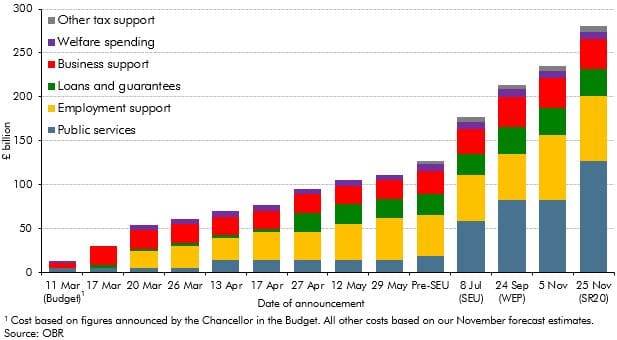

In the November 2020 EFO we estimated that policy measures responding to the coronavirus pandemic would add £280 billion to borrowing in 2020-21, with these policies announced across a number of statements beginning alongside the March Budget. This box considered the main statements contributing to this cost and the nature of the support included in these announcements.

In the Budget on 11 March, the Chancellor announced the first step in the Government’s fiscal response to the pandemic, setting aside £5 billion for the NHS and announcing £7 billion support for the self-employed, businesses and vulnerable people. This turned out to be the first of many virus-related support packages this year, several of which would have qualified as major fiscal events in their own right in a normal year.

Chart A documents the main steps along the road to the £280 billion total cost attached to virus-related policy measures in our central forecast. It uses the latest available cost of each measure rather than any that were stated at the time of an announcement or in one of our subsequent policy monitoring databases. And for policies that have been amended several times since their initial announcement, it only splits costs between announcements where they are material – as with the extensions to the CJRS – and where we have estimates to do so.

On 17 March, the Chancellor significantly increased the scale of the support measures announced the previous week – including the government-guaranteed loan schemes, business rates holidays and business grants. Based on our latest estimates, the initial cost of virus-related support had already reached £30 billion.

On 20 March, the Chancellor introduced the CJRS, which was to run for three months to the end of May (costing £18 billion in outturn), and announced the £20 a week increases in universal credit and working tax credits awards, and that local housing allowance rates for low-income private renters would rise (at a combined cost of £7 billion). On 26 March, he announced the first SEISS grant, covering a three-month period (costing £6 billion).

Further announcements followed in April. On 13 April, a statement disclosed that £14.5 billion in public services spending had been approved. On 17 April the CJRS was extended by one month to the end of June (costing £7 billion). And on 27 April the Chancellor supplemented the original business interruption loans with the fully guaranteed Bounce Back Loan Scheme (BBLS). Future calls on BBLS guarantees with respect to loans taken out by the initial end date of the end of October are expected to reach £19 billion.

The CJRS was extended by a further four months on 12 May (though full details of the flexible element came at the end of the month). On 29 May the second SEISS grant was announced. Together these cost £15 billion, taking the total cost of support above £100 billion.

Several smaller announcements made between the March Budget and the Summer Economic Update (SEU) were reflected in our Fiscal sustainability report in July or shortly after that.

At the SEU on 8 July, the Chancellor announced his Plan for Jobs, including a stamp duty holiday, temporary VAT cut for the hospitality industry and the Eat Out to Help Out scheme. Overall these cost £10 billion. More significantly, £40 billion of further public services spending was disclosed by this point. The job retention bonus included in the SEU has been shelved for now, so it does not add to the overall cost of support measures.

The Winter Economy Plan (WEP) on 24 September was the next major announcement. The loan schemes and temporary VAT cut were extended and a third and fourth SEISS payment added, but at significantly reduced generosity that was later increased. Again, the largest cost was attached to further public services spending (£24 billion). The WEP also included the job support scheme, which was overtaken by subsequent announcements, so does not add to the total. The WEP announcements took the total cost of virus-support for the year above £200 billion.

As England entered lockdown on 5 November, the generosity of third SEISS grant was increased back to the level of the first one, and the CJRS was extended to the end of March 2021. This added a further £21 billion to the overall cost for the year. The further virus support measures captured in this forecast raises the total by an additional £45 billion to £280 billion, almost entirely from increases to public services spending announced in the Spending Review.

The twelve major post-Budget fiscal policy announcements this year therefore cost an average of £22 billion each. This compares to the £22 to £29 billion a year fiscal loosening between 2021-22 and 2024-25 announced in the Budget in March, which was itself the largest sustained fiscal loosening since the pre-election Budget of March 1992.

Chart A: Cumulative cost of virus-related policy measures in 2020-21

This box was originally published in Economic and fiscal outlook – November 2020