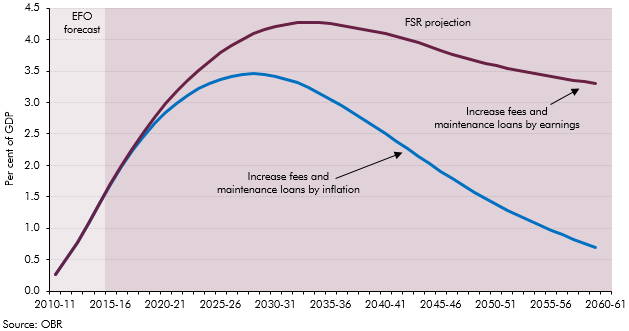

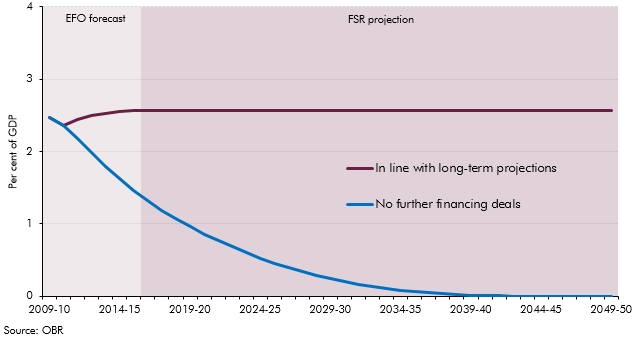

Our annual Fiscal sustainability report sets out long-term projections for spending, revenue and financial transactions, and assesses whether they imply a sustainable path for public sector debt. The FSR also analyses the health of the public sector’s balance sheet using both conventional National Accounts measures and the Whole of Government Accounts prepared using commercial accounting principles.

Fiscal sustainability report – July 2011

Supporting documents

Supplementary documents

Information or data which has been released as a result of external requests, since the original publication of the main document.