Solvency is not the only criterion that can be taken into account when assessing fiscal sustainability. This box outlined how generational accounts can be used to assess if future generations will be relatively worse off than current generations and the level of intergenerational fairness.

Solvency is not the only criterion that can be taken into account when assessing fiscal sustainability. For example, if the inter-temporal budget gap is equal to zero, this does not mean that the burden will be distributed equally across time or that it will move with spending. Future tax rises to pay off previously incurred debt will meet the solvency condition, but may not be considered intergenerationally fair.

A policy of delayed action would make future generations relatively worse off than current generations. This concern can be addressed using ’generational accounts’. These show the net discounted life-time contribution that people are expected to make to the public finances as a function of their age.

By combining these accounts for all existing generations it is then possible to calculate the account of all future generations that would satisfy a solvency condition. If the account for future generations is larger than that of current newborns this indicates that, on this definition, future generations are being treated unfairly. It is then possible to calculate the intergenerational budget gap, which represents the tax or spending change needed to close this generational imbalance.

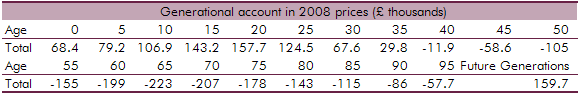

The National Institute of Economic and Social Research (NIESR), supported by the ONS, recently published updated generational accounts for the UK.a The table below sets out their calculations of the total net present value of future fiscal contributions of persons of various ages.

Table A: NIESR generational accounts

On the basis of NIESR’s figures, a current new-born baby would make an average net discounted contribution to the Exchequer of £68,400 over its life-time, whilst future generations would have to contribute £159,700 (discounted to 2008 but growing at 2 per cent per year).