Economic theory suggests that tax and spending can impact output directly, such as expenditure on infrastructure, or indirectly, such as influencing the decisions of households and firms. This box explored the empirical evidence on whether tax and spending has a level (temporary) effect on output growth, or a growth (permanent) effect.

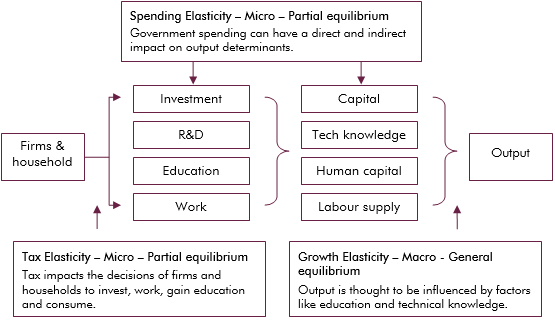

Microeconomic theory suggests that taxes can affect the choices made by households and firms by altering the prices of goods, services and activities. Growth theory suggests that some of those choices can affect output. As a result the level of tax can have an indirect effect on output as illustrated in Figure A. Different types of public spending can also impact output, either directly, such as expenditure on infrastructure, or indirectly, such as through transfer payments which influence the decisions of households and firms. This suggests the fiscal mix can matter for output.

Figure A: The relationship between tax, government spending and output

Empirical evidence on this is mixed, especially on whether tax and spending have a growth or a level effect on output.a A recent OECD paper (Arnold et.al, 2007) found evidence that the tax mix matters for the level of output and found corporate taxes to be most harmful, followed by personal income taxes and consumption taxes. A similar ranking was found in Gemmell and Kneller (2009) and Gordon and Lee (2005). Other papers have found no link between tax and the long-run growth rate (see Koester and Kormendi (1989) and Mendoza et.al (1997)). Poot and Nijkam (2003) conducted a meta-analysis and found limited evidence for a positive impact of fiscal policy on long-term growth but some evidence that spending on education and infrastructure had a positive impact. Canning and Pedroni (2004) also found infrastructure investment to have a positive impact on long-run growth in a cross country panel study.