Box sets » Public spending » Locally financed expenditure

In recent years, local authorities have increased their 'prudential' borrowing to take advantage of the low interest rates offered by the Public Loans Work Board. In this box we discussed the example of Spelthorne Borough Council, looking at some of its riskier investments in commercial property and how those may pose a risk to the public finances in the event of an economic downturn.

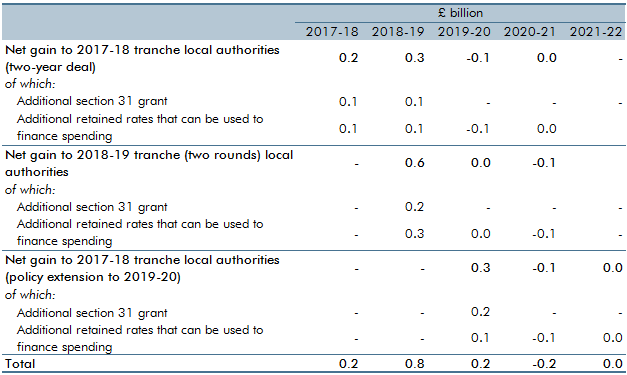

The Government has been piloting full business rates retention since 2017-18. These pilots featured in our forecasts from March 2017. This box reconsidered and re-estimated the fiscal effects of the 100 per cent local retention pilots scheme.

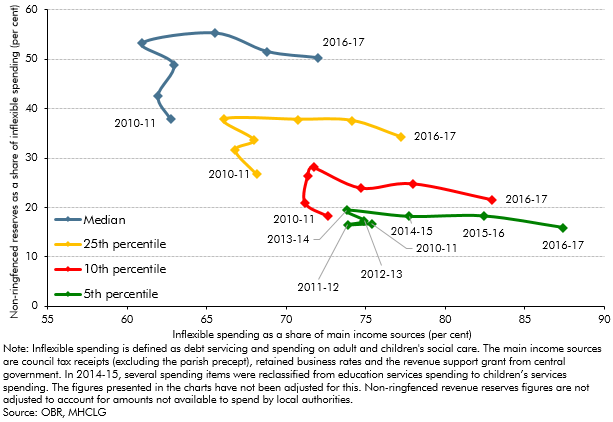

Local authorities’ net use of reserves (the amount they add to or drawdown from their stock of reserves) is a key judgement in our fiscal forecasts. This box from our March 2018 EFO examined two indicators of the general financial health of English local authorities over the period 2010-11 to 2016-17, assessing how these metrics might be used to inform our forecast judgements.

Local authorities’ net use of reserves (the amount they add to or drawdown from their stock) is a key judgement in our local authority current spending forecasts as it directly affects borrowing. This box outlined recent trends in use of current reserves, split by English authorities with and without upper-tier responsibilities (such as education and social care), which underpinned our November 2017 forecast judgements.

Business rates are a major source of locally-raised finance used to fund locally-administered spending. The Government announced in Autumn Statement 2015 that it would let English local authorities retain 100 per cent of business rates by the end of the Parliament. This box outlined the change in local government financing arrangements and the responsibilities that might be devolved, as well as how these changes would affect our forecast.

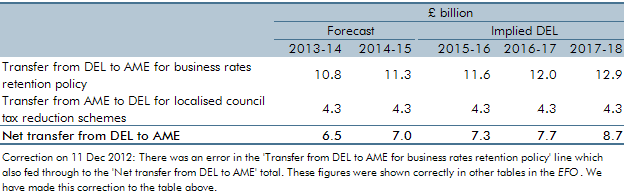

In this forecast there were two policy switches that shifted spending between RDEL and AME, which applied from 2013-14 onwards. These policies were for the 50 per cent retention of business rates for local authorities in England, and for localised council tax reduction schemes. This box outlined these changes and examined the subsequent impact these would have on our forecasts.

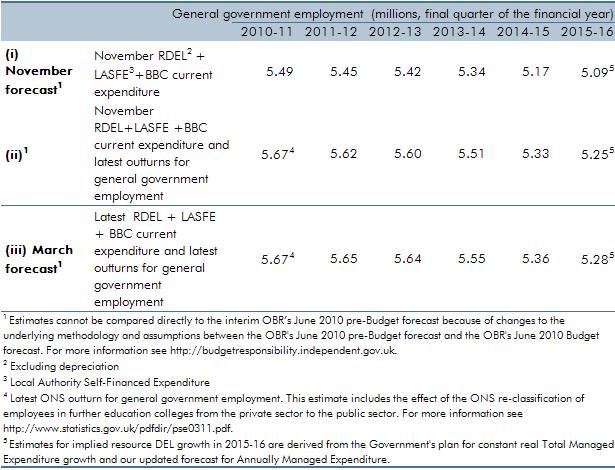

Our general government employment (GGE) forecast is based on projections of the growth of the total government paybill and paybill per head, which is in turn based on the Government's latest spending plans. Ahead of our March 2011 forecast, ONS estimates of general government employment were revised up, largely reflecting the reclassification of employees in further education colleges. In this box we set out the extent to which changes to our general government employment forecast were a result of our revised projections for paybill growth as opposed to data revisions.