In this forecast there were two policy switches that shifted spending between RDEL and AME, which applied from 2013-14 onwards. These policies were for the 50 per cent retention of business rates for local authorities in England, and for localised council tax reduction schemes. This box outlined these changes and examined the subsequent impact these would have on our forecasts.

In this forecast there have been two switches between DEL and AME, from 2013-14 onwards, for two policies that affect local authority finances.

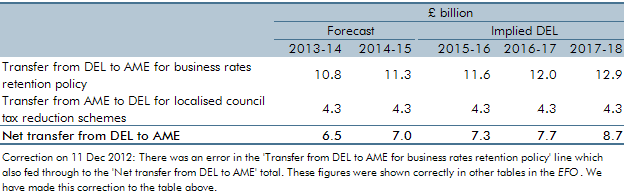

Table D: DEL and AME switches for business rates and council tax benefit

Local authorities in England currently transfer all the business rates that they collect in their area to the Department for Communities and Local Government, which then gives the money back to local authorities as grants in DEL, based on local authorities’ relative requirements. Under the new policy, from next year local authorities will retain around half of the business rates that they collect, with an ongoing redistribution to ensure that no local authority will gain or lose from the change, at least initially.

As a result of this policy measure, the amount of DEL grant to local authorities will be reduced by the amounts shown in the table above, but our forecast for overall local authority spending is unchanged because the spending from grants is replaced by an increase in self-financed spending in AME funded by the retained business rates. The DEL to AME transfer is calculated as half of the Estimated Business Rates Amount (EBRA), This is consistent with the England element of the business rates forecast in this EFO, adjusted to remove components that are not covered by this policy.a

Local authorities currently administer the payment of council tax benefit, with DWP paying them a grant within AME to cover most of the payments they make. From next year, local authorities will set up their own localised council tax benefit reduction schemes. In 2013-14 and 2014-15, the previous DWP demand-led grants to local authorities in AME will be replaced by additional DEL grants, as shown in the AME to DEL transfers in Table D above. A 10 per cent reduction in council tax benefit spending has been included in the social security forecast since it was announced in the 2010 Spending Review and the increases in DEL grants in 2013-14 and 2014-15 are based on our council tax benefit forecasts in this EFO, including this reduction.

The forecast for council tax benefit in this EFO has been produced by DWPb and quality assured by OBR in the usual way. The forecast includes estimates of the impacts of the measures in the Autumn Statement.