International organisations provide comparisons of deficit and debt levels. This box facilitated international comparisons by providing projections of Treaty debt and deficit on a calendar year basis.

This box is based on IMF World Economic Outlook and European Commission data from September 2011 and September 2011 respectively.

This box looks at how the government borrowing and debt levels of the UK compare with other countries. The government’s preferred measures are public sector net borrowing (PSNB) and public sector net debt (PSND), both excluding financial interventions. In line with the Government’s financial and budgeting frameworks, these are shown on a financial year basis.

International organisations such as the European Commission, the IMF and the OECD all provide comparisons of deficit and debt levels. These are on a general government basis i.e. they exclude public corporations. They are also on a calendar year basis.

- European Commission: Treaty deficit (general government net borrowing) and Treaty debt (general government gross debt);

- IMF: general government measures of net borrowing, gross and net debt; and

- OECD: general government gross and net financial liabilities. This is a wider concept with a larger coverage of liabilities and assets.

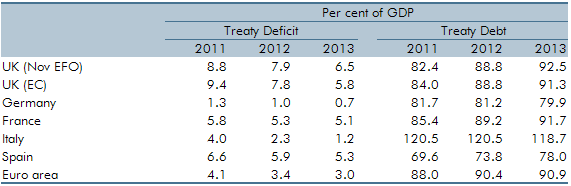

To facilitate international comparisons, we provide projections in this box for Treaty debt and deficit on a calendar year basis. The UK will continue to be assessed on a financial year basis for the Maastricht Treaty debt and deficit targets. We have also produced a general government net debt projection on the same basis as the IMF, based on subtracting estimates of liquid assets from the general government gross debt forecast. Our intention is to generate a forecast on the OECD basis for Budget 2012. With both modelling and reporting of much tax and spending done primarily on a financial year only, the calendar year forecasts are illustrative and have been generated simply by weighting the financial year forecasts appropriately (i.e. the 2012 forecast would be three-quarters of the 2012-13 forecast and one-quarter of the 2011-12 forecast). Table A looks at our latest forecasts for Treaty deficit and debt against the Autumn 2011 forecasts from the European Commission for 2011 to 2013. Relative to the main European countries, the UK deficit remains high in 2013. The UK’s Treaty debt levels are now close to the euro area average.

Table A: Comparison with European Commission Forecasts

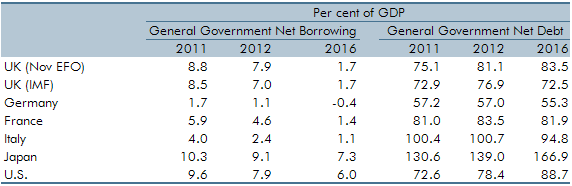

Table B looks at our latest forecasts for general government net borrowing and general government net debt against the IMF’s World Economic Outlook forecasts from September 2011. The debt level is also markedly above the IMF’s latest forecast. By 2016, government borrowing in the UK is expected to be similar to a number of European countries, but well below the projected deficits of the US and Japan.

Table B: Comparison with IMF Forecasts