Box sets » Devolution

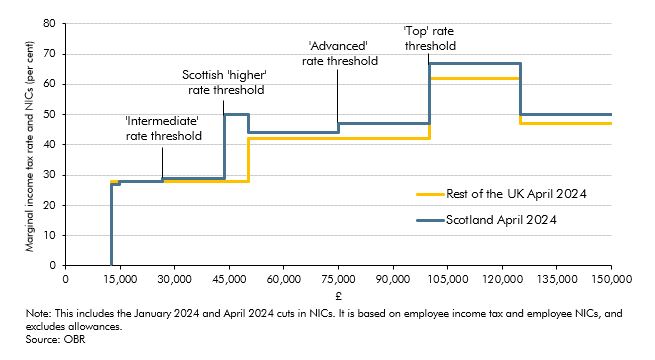

Income tax was devolved to the Scottish Government in 2016 and policy changes since then have led to a divergence with the UK Government’s income tax system. In this box we explored the costing of the Scottish Government’s December 2023 decision to introduce a new 45 per cent ‘advanced’ rate and to raise the ‘top’ rate to 48 per cent, including the potential behavioural responses.

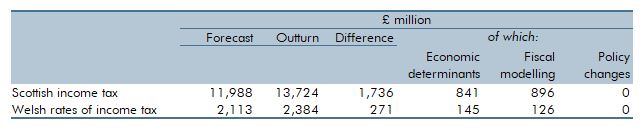

Income tax was devolved to the Scottish Parliament in 2016 and the Welsh Senedd in 2019. In this box we evaluated our March 2021 forecasts for 2021-22, and how they compared to the eventual outturn data. This was a particularly difficult period to forecast given the economy was recovering from the unprecedented impact of the Covid-19 pandemic. The double-digit difference between our initial forecast and the final outturn, for both Scotland and Wales, is largely explained by the faster-than-expected post-pandemic recovery.

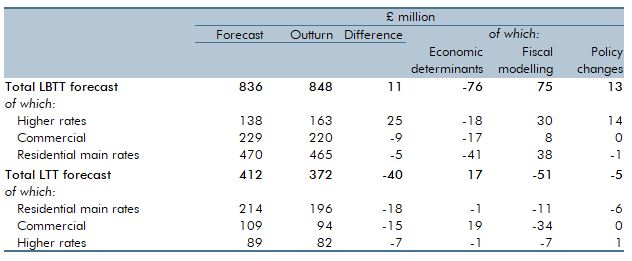

The land and buildings transaction tax (LBTT) was implemented in Scotland on April 1 2015 while the land transactions tax (LTT) began in April 1 2018. Both taxes replaced the UK Government’s stamp duty land tax but operate in similar ways. In this box we evaluated our March 2022 forecasts for 2022-23, and how they compared to the eventual outturn data. We explained the reasons behind the 1.4 per cent surplus for LBTT and the 9.6 per cent shortfall for LTT.

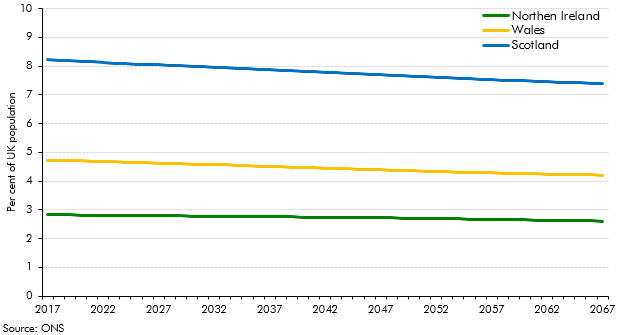

This box looked at differences in the Office for National Statistics’ population projections for the four constituent nations of the UK. It discussed the nations’ relative size and ageing, and possible implications for fiscal sustainability.

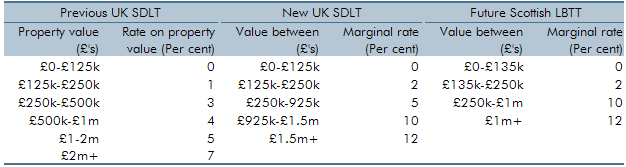

The Government announced substantial reforms to the residential stamp duty land tax (SDLT) system at Autumn Statement 2014. This box explored how the tax system changed and how these reforms were costed.