Income tax was devolved to the Scottish Parliament in 2016 and the Welsh Senedd in 2019. In this box we evaluated our March 2021 forecasts for 2021-22, and how they compared to the eventual outturn data. This was a particularly difficult period to forecast given the economy was recovering from the unprecedented impact of the Covid-19 pandemic. The double-digit difference between our initial forecast and the final outturn, for both Scotland and Wales, is largely explained by the faster-than-expected post-pandemic recovery.

This box is based on OBR data from March 2024 .

Through our evaluations of successive forecast for the devolved income taxes, we have concluded that they have generally improved with time as we incorporate more income tax outturn data from across the UK’s three income tax systems, as well as the improved our use of RTI data. Because of the lag in publishing income tax outturn data for Scotland and Wales, we can only analyse our devolved income tax forecasts well after the end of the year to which they relate.

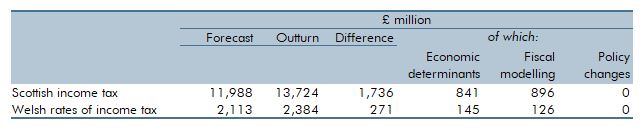

Outturn data for 2021-22 was published in July 2023, so we can now evaluate our forecasts for Scottish income tax and the Welsh rates in that year. Doing so is important for transparency and helps us to understand and identify ways to improve our methodology and modelling. This was a particularly difficult period to forecast given the economy was recovering from the unprecedented impact of the pandemic. Table A compares our March 2021 forecasts for Scottish income tax and the Welsh rates in 2021-22 to the eventual outturn. It shows that:

- Scottish income tax liabilities were £1,736 million (14.5 per cent) higher than forecast, the largest absolute year-ahead error since we began forecasting Scottish income tax. This error is broadly evenly split between economic determinants and fiscal modelling. Economic determinants generated a surplus of £841 million. This reflected the 4.0 percentage point surplus in UK-wide wages and salaries in 2021-22 relative to our March 2021 forecast, driven by a much stronger than expected post-pandemic recovery in earnings and employment. Fiscal modelling contributed a further £896 million to the surplus, reflecting stronger-than-expected pay growth driving more fiscal drag (as earnings growth moves taxpayers into higher tax bands) than anticipated. This was slightly offset by assumptions about the Scottish share, which was materially lower than expected, at 6.59 per cent versus the 6.70 per cent forecast.

- Liabilities for the Welsh rates were £271 million (12.8 per cent) higher than forecast. Economic determinants accounted for £145 million (6.9 per cent) of the difference, again reflecting the stronger-than-anticipated post-pandemic labour market recovery. Fiscal modelling further contributed to the upside surprise, generating a surplus of £126 million, once again reflecting stronger aggregate pay growth. This was slightly offset by the Welsh share of UK outturn being slightly lower than expected, at 1.15 per cent versus the 1.17 per cent forecast.

Policies announced after our March 2021 forecast had almost no impact on the forecast differences in either Scotland or Wales.

Table 3.C: Scottish income tax and Welsh rates of income tax in 2021-22: March 2021 forecast versus outturn

This box was originally published in Economic and fiscal outlook – March 2024