The land and buildings transaction tax (LBTT) was implemented in Scotland on April 1 2015 while the land transactions tax (LTT) began in April 1 2018. Both taxes replaced the UK Government’s stamp duty land tax but operate in similar ways. In this box we evaluated our March 2022 forecasts for 2022-23, and how they compared to the eventual outturn data. We explained the reasons behind the 1.4 per cent surplus for LBTT and the 9.6 per cent shortfall for LTT.

This box is based on OBR data from March 2024 .

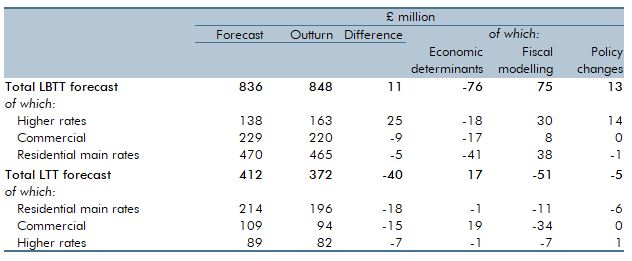

Table A compares our March 2022 forecast for 2022-23 Scottish and Welsh property transaction taxes to the latest outturn data. The overall differences were relatively small in percentage terms – outturn exceeded our LBTT forecasts by £11 million (1.4 per cent), while our LTT forecast fell short by £40 million (9.6 per cent).

Scottish LBTT

The £11 million surplus is entirely due to the additional dwelling supplement (ADS) as receipts for both residential main rates and commercial fell short of expectations. Taking each in turn:

- The additional dwelling supplement outperformed our forecast by £25 million (18 per cent). This was driven by the composition of transactions with relatively more ADS transactions than we expected and relatively fewer residential main rate transactions. This accounts for £30 million of the surplus. The 2 percentage point increase in the ADS rate that was announced in December 2022 contributes a further £14 million. Weaker-than-expected growth in the volume of residential transactions offset this by £18 million.

- Commercial receipts were £9 million (4 per cent) lower than we forecast, which is explained by the lower-than-expected growth in the value of transactions and partially offset by transactions proving more tax-rich than anticipated.

- Residential main rates fell slightly short of our forecast, by £5 million (1 per cent), with some large but offsetting compositional differences within this. The lower-than-expected

growth in the volume of transactions, offset somewhat by higher-than-expected average price growth, lowered receipts by £41 million. But this was further offset by the composition of residential property transactions proving more tax-rich than anticipated and losses to reliefs being smaller than expected, which offset £38 million of that downside surprise.

Welsh LTT

A £40 million shortfall versus forecast reflects different factors across the three markets:

- Residential main rates receipts were £18 million (8.3 per cent) lower. This is due to overestimating the size of the in-year estimate that we made using the 2021-22 data and also due to the October 2022 measure that increased the LTT threshold from £180,000 to £225,000, as well as correcting a modelling error.a

- Commercial receipts were £15 million 13.5 per cent lower than we forecast. This is also due to overestimating the size of the in-year estimate that we made using the 2021-22 data, offset by a rebound in prices and transactions. a

- Higher rates on additional properties were £7 million (7.9 per cent) lower than forecast, which was the net impact of two factors. The value of transactions outperformed expectations, there were compositional differences in the distribution of transactions relative to our forecast.

Table 4A: Devolved property taxes in 2022-23: March 2022 forecast versus outturn

This box was originally published in Economic and fiscal outlook – March 2024

a Welsh taxes outlook, February 2024.