Box sets » Net lending and balance sheets » Sector net lending

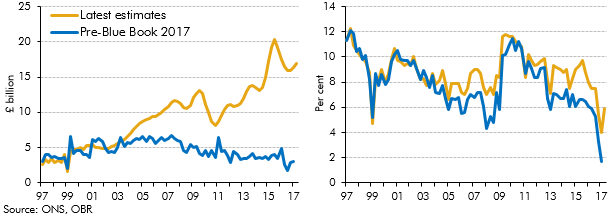

In recent years there has been a significant increase in the number of people setting themselves up as single-director companies (‘incorporations’), implying an increase in the share of household income received as dividends. ONS estimates of households dividend income were revised significantly as part of Blue Book 2017, and better capture this rise in incorporations. This box discussed the implications of these revisions, which implied a much higher level of household disposable income and household saving than previous estimates.

In each Economic and fiscal outlook we publish a box that summarises the effects of the Government’s new policy measures on our economy forecast. These include the overall effect of the package of measures and any specific effects of individual measures that we deem to be sufficiently material to have wider indirect effects on the economy. In our December 2012 Economic and Fiscal Outlook, we made adjustments to our forecasts of real GDP, inflation and property transactions

The Funding for Lending Scheme (FLS) was launched by the Bank of England and the Government in July 2012 to encourage banks and building societies to expand their lending by providing funds at lower rates than prevailing market rates. This box discussed the uncertainties associated with the transmission mechanism of this scheme and the possible impact on real GDP.

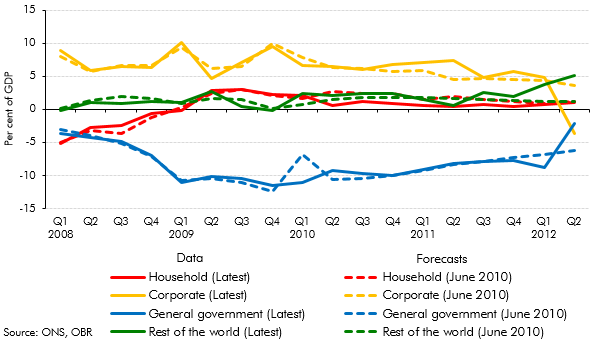

An alternative way to view the sectoral decomposition of the economy is to look at the financial balances of households, firms, government and the rest of the world. This box explored net lending by sector from 2008 to 2012, and how this compared with our June 2010 forecast

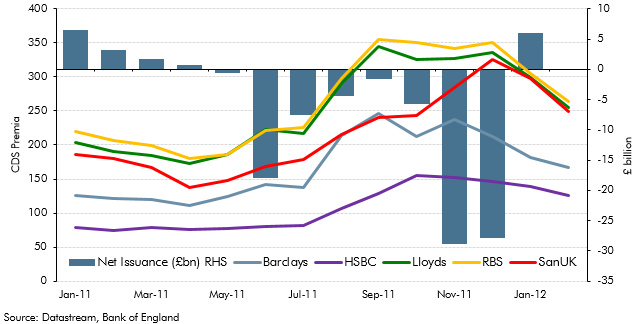

Central banks around the world launched two significant new market operations at the end of 2011. This included a program to provide liquidity support to the global financial system, as well as longer-term refinancing operations by the ECB. This box analysed the impact of these operations on the UK financial sector by looking at net capital issuance and five-year credit default swap (CDS) premia of UK banks. In light of these developments, we made adjustments to our forecast of CDS premia in our March 2012 forecast.

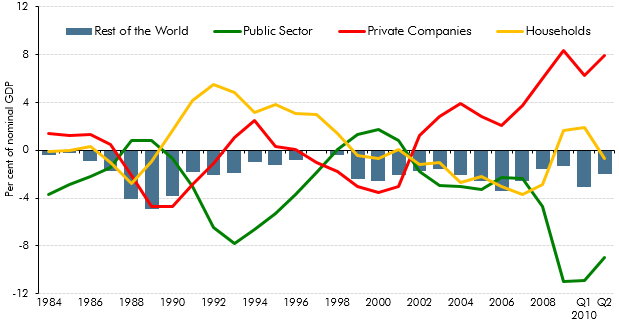

A rebalancing away from private consumption towards investment and net trade was a theme of our November 2010 forecast. This box set out the key features of domestic sector balances over the preceding two decades.