Central banks around the world launched two significant new market operations at the end of 2011. This included a program to provide liquidity support to the global financial system, as well as longer-term refinancing operations by the ECB. This box analysed the impact of these operations on the UK financial sector by looking at net capital issuance and five-year credit default swap (CDS) premia of UK banks. In light of these developments, we made adjustments to our forecast of CDS premia in our March 2012 forecast.

This box is based on Datastream premia and Bank of England capital issuance data from March 2012 and February 2012 respectively.

Since our November forecast, central banks launched two significant new market operations designed to ease pressures in the financial markets. On November 30 2011 the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the US Federal Reserve and the Swiss National Bank announced a program providing liquidity support to the global financial system. The action was designed to make it easier and less costly for banks to fund themselves in US dollars, addressing a shortage experienced by many euro area banks. The announcement appears to have had a positive impact on funding markets in both the euro area and the UK.

However, funding conditions in the euro area remained tight and on December 8 2011 the ECB announced that it would offer unlimited 3 year loans to euro area banks at its main interest rate of 1 per cent. This longer-term refinancing operation (LTRO) seems to have significantly eased pressures in the euro area financial sector and removed the immediate risk of large-scale bank failures.

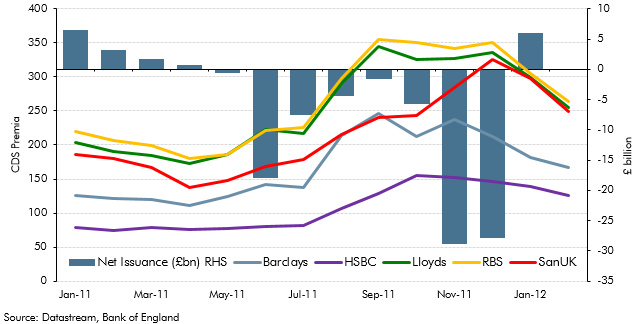

Chart A: 5-year CDS premia and net capital issuance by UK banks

The reduction in credit risk that followed the LTRO encouraged banks to lend to one another and led to a further fall in the cost of borrowing. Chart A shows that the UK’s largest lenders, some of which participated in the LTRO, have experienced significant reductions in the cost of borrowing, as measured by their credit default swap (CDS) premia. Chart A also shows that, in January 2012, banks issued more capital than they redeemed for the first time since April 2011.

The LTRO has materially improved the credit outlook for the UK economy but CDS premia remain elevated relative to the first half of 2011 and we continue to expect lending spreads over bank rate to businesses and households to rise over the coming year. Chart 3.10 shows the adjustments we have made to our forecast of CDS premia since November.