With the sale of new petrol and diesel cars to be banned from 2030, the transition to electric vehicles is a key element in the UK’s path to net zero emissions. This box outlined the recent growth in alternatively fuelled vehicle sales, the fiscal implications of this and the role of policy in the transition.

This box is based on DfT and SMMT data from April and May 2021 .

Growth in electric and hybrid vehicles

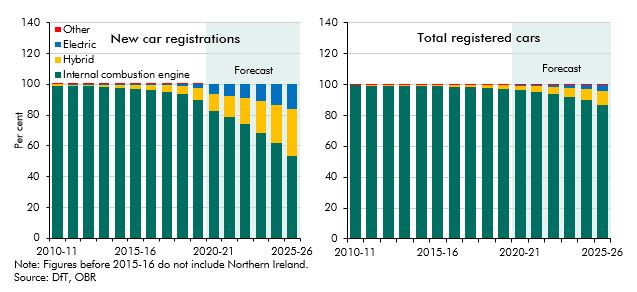

The transition from fossil fuel to electric vehicles is a key element in the UK’s path to net zero emissions, accounting for 23 per cent of the total reduction in emissions by 2050. Unlike domestic heating (Box 3.3), this transition is already well underway. Alternatively-fuelled vehicles made up more than a fifth of new car sales and around 3 per cent of all cars in 2020. Hybrid cars were still only 1.1 per cent of new car sales in 2010, but had risen rapidly to reach 14.2 per cent of total sales last year. Pure electric vehicle sales grew very slowly at first, just reaching 1 per cent of new car sales in 2019, but leapt to 6.5 per cent of sales last year.a

Because the average car stays on the road for 14 years, the share of electric cars in the total stock of cars is much lower. By 2025-26, our latest forecast assumes that hybrids will make up 31 per cent of sales and 9 per cent of all cars, with the corresponding figures for fully electric vehicles being 16 and 4 per cent (Chart A).b

Chart A: New car registrations and total car stock by power type

Fiscal implications of electric vehicles

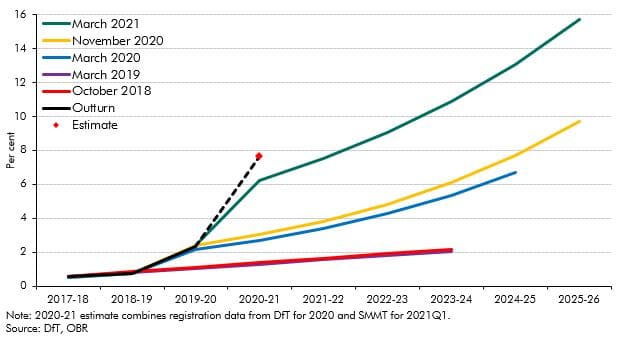

The share of electric vehicles in new car sales has important implications for government revenues from fuel duty and vehicle excise duty (VED), as purely electric vehicles pay neither, and the pace at which that share has risen has consistently outpaced that assumed in our EFO forecasts (Chart B). Indeed, if the pace of increase in 2020-21 assumed in our March 2021 forecast of 3.8 percentage points were to persist over the next five years, rather than the 1.9 percentage points a year the forecast assumes, fuel duty and VED receipts would be £0.5 billion lower in 2025-26. We will revisit this assumption ahead of our next forecast.

Chart B: Successive assumptions for electric vehicles as a share of new car sales

The sale of new fossil fuel cars will be banned from 2030, with hybrid car sales banned from 2035. On unchanged fuel duty and VED policies, once the entire vehicle stock has turned over, that will result in a revenue loss of 1.5 per cent of GDP (equivalent to £31 billion in today’s terms). This is a key component of the fiscal cost of getting to net zero emissions.

The role of policy in incentivising the transition

The switch to electric vehicles has so far been slower for private buyers than for businesses – which accounted for two thirds of electric vehicle registrations in 2020.c But public attitudes are changing – a recent Ofgem survey found a quarter of consumers intend to purchase an electric vehicle in the next five years.d Indeed, following the sales ban announcement in the Prime Minister’s 10 Point Plan, UK consumer internet searches for electric vehicles doubled overnight.e

Other policy measures can play a role in accelerating this transition in the interim. There is evidence that countries offering greater financial incentives have higher take-up of electric vehicle, with the accelerated shift seen across Europe attributed to generous incentives and more stringent emissions regulations.f,g In the UK, the Government set up the Office for Zero Emission Vehicles in 2009 to support the transition. Since 2011, the Government has utilised a range of policy incentives, and has put aside funding of £2.8 billion to support the transition, including:

- Demand incentives. These include grants that contribute up to £2,500 to the purchase of a new battery electric vehicle. These subsidies are in place until 2022-23 but have been successively scaled back since their introduction as vehicle prices have fallen. Demand for hybrids temporarily fell following their exclusion from the scheme in 2018, but sales quickly picked up again.h The tax system also encourages electric vehicles, as they are exempt from VED and fuel duty. As well as these financial incentives, the Government, in conjunction with industry, has set up the ‘Go Ultra Low’ campaign to inform consumers of the benefits of electric vehicles, such as their lower running costs.

- Infrastructure investment. £1.3 billion has been committed to installing public, home and workplace charging points over the next four years. The number of public charging points more than trebled between 2016 and 2020 to reach 21,000 in 2020.i Yet this is still less than 10 per cent of the projected need for public charging points by 2030.

- Regulations to discourage use of conventional vehicles. These include the introduction of emissions-linked charges to drive into some cities by local administrations, such as the Ultra Low Emission Zone in London from 2019 and Clean Air Zones in Bath and Birmingham introduced this year. EU legislation has imposed increasingly stringent emissions targets for car manufacturers since 2015, and these were transferred into UK law following the end of the Brexit transition period. From 2020, these require stretching reductions in manufacturers’ average new fleet emissions, with fines levied for noncompliance. Registering electric vehicles gains manufacturers ‘super credits’ that lower their average fleet emissions for the purposes of the targets. This is thought to have played a key role in the uptick in electric vehicle registrations across Europe last year.j

- Supply-side measures. These include measures to support technological innovation, design, and manufacturing of electric vehicles, such as the £30 million of public investment in battery technology research, as well as proposals for a UK-based lithium extraction plant. The Government has also stated its ambition to develop a UK Gigafactory producing electric vehicle batteries at scale.

In contrast to many aspects of the transition to net zero, the need for policy measures to

encourage the switch to electric vehicles is projected to fall away relatively quickly. The CCC

projects that the combined purchase price and lifetime running costs of an electric car will be

lower than for a fossil-fuel one by 2025, and cheaper in terms of purchase price alone from

2030. But much of this depends on further falls in battery prices, which have tumbled over the

past three decades. For example, the current Tesla Model S battery, which costs $13,600, would

have cost more than $500,000 in 1991 – a 97 per cent fall in the space of thirty years.k

This box was originally published in Fiscal risks report – July 2021