In recent years, the UK has entered into tax agreements with a number of offshore centres. This box evaluated the Autumn 2012 costing for the UK-Swiss tax agreement. More information can be found in Working paper No.8: Anti-avoidance costings: an evaluation

The UK has entered into agreements with a number of offshore centres that are designed to ensure effective taxation of UK individuals with offshore assets. Estimating the prospective yield from such agreements is difficult due to the lack of information on the assets held in offshore centres and the extent of any behavioural response to these agreements.

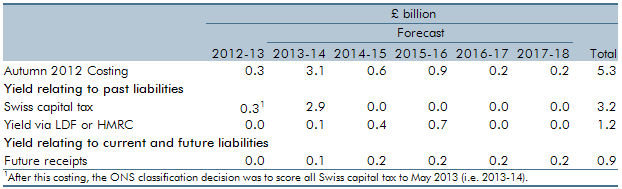

The costing for the UK-Swiss tax agreement was certified at Autumn Statement 2012. It consisted of a one-off payment covering tax liabilities between 2003 and 2012, plus a future withholding tax from 2013 onwards. Original estimates from HMRC suggested a yield of between £4 billion and £7 billion from the agreement.a Table C shows the costing certified in Autumn 2012. Of the £5.3 billion yield, £4.4 billion related to past liabilities, at the lower end of the original HMRC estimate, and £0.9 billion related to the future withholding tax.

Table C: Autumn 2012 costing for UK-Swiss tax agreement

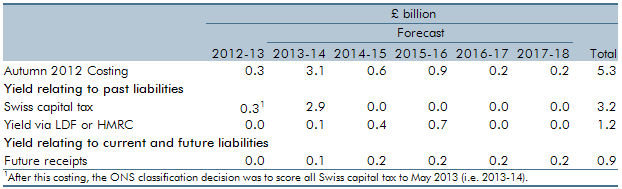

At the time, we stressed the uncertainty of the original costing due to the lack of hard information about the value of UK individuals’ financial assets in Switzerland, and how these individuals would respond to the policy. Both receipts data and the July announcement from the Swiss Bankers’ Association (SBA)b indicate that the yield from the one-off levy (Swiss capital tax) will be significantly lower than estimated in the certified costing. Receipts of Swiss capital tax have totalled £789 million so far this year. Table D shows the revised costing for the UK-Swiss tax agreement included in our latest forecast.

Table D: Revised costing for UK-Swiss tax agreement

The overestimate in this costing is in contrast to the Liechtenstein Disclosure Facility (LDF), which has yielded over £800 million to date (excluding receipts related to the Swiss agreement) with two-and-a-half years left to run. This compares to an initial costing of £1 billion.

The lower-than-expected yield is likely to reflect both a smaller initial tax base and a larger behavioural response than was estimated. The smaller tax base is likely to reflect some combination of: fewer assets held by UK individuals in Swiss banks; more of the assets belonging to non-domiciles or people who are already compliant; and the failure of Swiss banks to identify UK individuals holding assets; or circumvention of the deal. The SBA announcement suggested a high number of individuals with non-domicile status. The extent of capital flight to other offshore centres is likely to have been greater than expected.

Individuals could disclose via the LDF or to HMRC directly rather than pay the levy on their Swiss assets. There are indications that a higher proportion of individuals have decided to disclose via these routes. However, evidence from LDF and HMRC cases so far suggests that the average yield per case is lower than expected. As a result, the yield expected from these two routes has been reduced to less than half the original costing. The smaller-than-expected tax base means that the yield from the future withholding tax has also been revised down.

In Budget 2013, we certified the expected yield from other tax agreements and disclosure facilities, such as those with Jersey, Guernsey and the Isle of Man. The overall yield from these agreements between 2013-14 and 2017-18 is expected to be just over £1 billion. Reflecting experience of the Swiss agreement, we have re-profiled the yield between years, but left the total unchanged. Compared with the Swiss agreement, there is better information on the size of funds and we have reduced the estimate of UK funds by around 80 per cent to allow for substantial numbers of individuals having non-domicile status and for many to be compliant already or to have disclosed via previous HMRC schemes. This is a larger reduction than assumed in the UK-Swiss tax agreement.

Information agreements with several British Overseas Territories were announced at the Autumn Statement. These will provide additional information on UK accounts and assets held in these territories. The costing includes the lessons from previous costings relating to offshore centres.