Box sets » Receipts » UK-Swiss tax agreement

This box evaluated anti-avoidance measures implemented between 2011-12 and 2013-14. The exercise confirmed that while these costings were subject to significant uncertainty, there was no evidence of systematic bias.

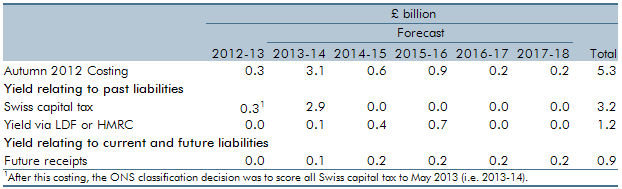

In recent years, the UK has entered into tax agreements with a number of offshore centres. This box evaluated the Autumn 2012 costing for the UK-Swiss tax agreement. More information can be found in Working paper No.8: Anti-avoidance costings: an evaluation

In each Economic and fiscal outlook we publish a box that summarises the effects of the Government’s new policy measures on our economy forecast. These include the overall effect of the package of measures and any specific effects of individual measures that we deem to be sufficiently material to have wider indirect effects on the economy. In our December 2012 Economic and Fiscal Outlook, we made adjustments to our forecasts of real GDP, inflation and property transactions