In May 2022, the Government announced a package of measures to support households with the cost of living. In this box, we explained how we had adjusted our March 2022 Economic and fiscal outlook forecast for these policies.

This box is based on OBR data from June 2022 .

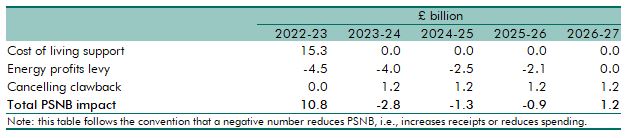

On 26 May, the Chancellor announced a further package of measures to support households with the cost of living this year. It comprised three elements, as set out in Table A. First, payments to households in 2022-23 via several different schemes that the Treasury estimates will cost £15.3 billion. These include:

- an additional £200 energy bills discount for all households at a cost of £6.0 billion;

- one-off cost-of-living payments of varying sizes for those on: means-tested benefits (£650 per recipient, costing £5.4 billion), pensioners (£300 per recipient, costing £2.5 billion); and those on disability benefits (£150 per recipient, costing £0.9 billion); and

- a £500 million increase and extension of the Household Support Fund.

This additional spending is partially funded by revenue raised from a new ‘energy profits levy’ (EPL) within the North Sea fiscal regime. The levy represents an additional 25 per cent surcharge on the profits of the oil and gas sector that will be abolished by the end of December 2025, or sooner if the Government removes it on the basis of energy prices returning to historically more normal levels.a The Treasury estimated that the EPL would raise around £5 billion in its first 12 months of operation (i.e., from 27 May 2022 to 26 May 2023). We will scrutinise this estimate at our next EFO. But in the meantime, following consultation with the Treasury, to produce estimates of the measure’s yield over its full lifetime, we have: (i) estimated its yield in 2022-23 by scaling down the £5 billion figure to adjust for the scheme starting partway through the current fiscal year; then (ii) scaled that £4.5 billion figure down further for 2023-24 and 2024-25 reflecting declining oil and gas prices in our March 2022 EFO; and finally (iii) scaled down 2024-25 revenues by a quarter to reflect the removal of the EPL at the end of December 2025.

The final component of the package was to cancel the planned clawback of the initial £200 energy bills rebate announced in the Spring Statement in March. This payment was due to raise £1.2 billion a year from 2023-24 to 2027-28 and will now raise nil.

We have not made explicit changes to our March economy forecast to account for the impact of the policies, except to reflect the measures’ direct impact in calculations of the outlook for household disposable income growth. In our next EFO, we will scrutinise the costing of each policy and consider any additional indirect effects on the economy.

Table A: The direct fiscal costs of the Government’s 26 May policy package

This box was originally published in Fiscal risks and sustainability – July 2022