Our 2016 Forecast evaluation report was published around four months after the EU referendum was held. Over that period forecasters had revised their real GDP growth and borrowing forecasts. This box summarised those revisions and the relationship between them. It illustrated the uncertainty that forecasters faced in trying to predict the impact of the referendum result and Brexit on the economy and public finances.

This box is based on HM Treasury real GDP and PSNB forecasts data from September 2016 .

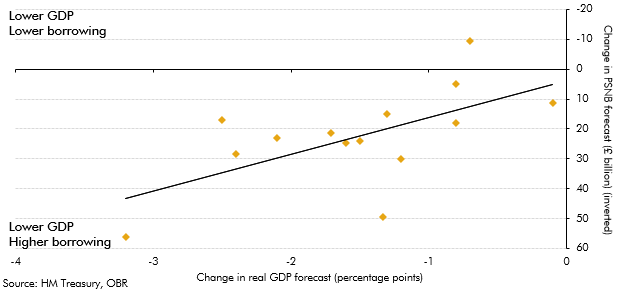

Since the EU referendum result in late June, forecasters have been revising their GDP growth and borrowing forecasts. Chart A presents the revisions between March and July for real GDP growth and public sector net borrowing (PSNB) in 2017-18. The wide range illustrates the uncertainty that forecasters face in trying to predict how the economy and public finances might be affected. The chart shows that there is also considerable variation over the extent to which forecasters expect the public finances to be affected for a given change in real GDP growth. In statistical terms, only around 40 per cent of the variation in the PSNB forecasts is explained by variation in the real GDP forecasts. As the analysis of fiscal forecasting errors in this chapter shows, there are many factors other than GDP growth assumptions that affect the public finances.

The variation shown across forecasts in Chart A is greater than the variation in our own forecast revisions, as set out in Annex B of our March 2016 Economic and fiscal outlook. In that analysis we focused on revisions over a 5-year horizon, so the results are not directly comparable. But using the same statistical metric, we showed that variation in real GDP revisions explained around 70 per cent of the variation in our borrowing revisions. For nominal GDP, which is the more important measure for the public finances, that figure increased to around 80 per cent.

While there is considerable variation in the relationship between growth and borrowing shown in Chart A, it is interesting that on average a 1 percentage point change in real GDP growth leads to around a £12 billion (roughly 0.6 per cent of GDP) change in borrowing. This figure would be smaller if the forecast that included the biggest hit to both GDP and borrowing was excluded.

That £12 billion is close to what would be implied by the cyclical adjustment coefficients that we use in our fiscal forecasts. In ‘Cyclically adjusting the public finances’, we estimated that in response to a 1 per cent change in the output gap borrowing would move by 0.5 per cent of GDP in year one and 0.7 per cent of GDP in year two.

Chart A: Revisions to forecasts of real GDP in 2017 and PSNB in 2017-18

This box was originally published in Forecast evaluation report – October 2016