As we finalised our pre-measures forecast on 26 September, our forecast did not include the Quarterly National Accounts released on 30 September 2024, which contained Blue Book 2024 consistent revisions. This box examined the potential implications that including the latest data may have had on our forecast. We judged that the data revisions would have provided limited new information on current economic conditions, leaving our economic and fiscal forecast broadly unchanged.

This box is based on ONS data from September 2024 and August 2024 .

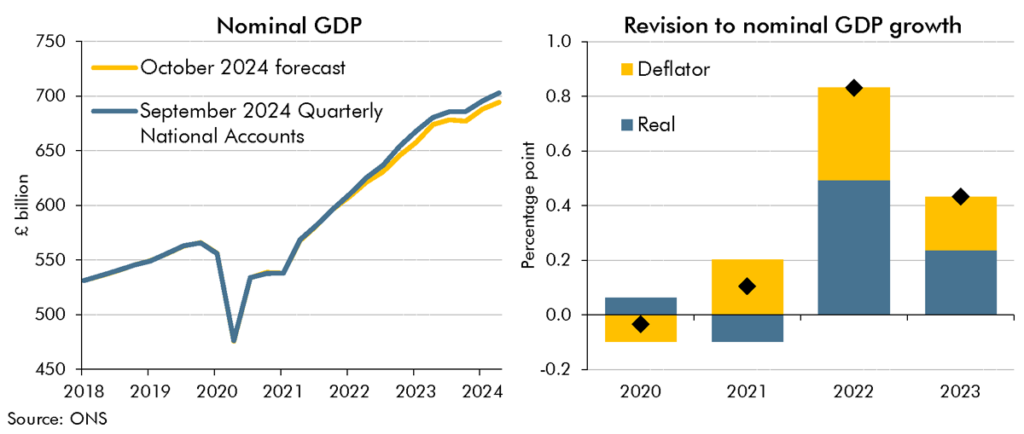

The Blue Book is an annual ONS publication which updates the sources and methods used for the UK National Accounts. The Blue Book 2024 will be published on 31 October. The implications for GDP up to and including 2022 were preannounced on 7 August.a The complete revisions to GDP from the Blue Book, including 2023 and the first half of 2024, were incorporated into the Quarterly National Accounts (QNA) published on 30 September. Since the full revisions were published after our pre-measures economy forecast was finalised, they were not incorporated into our forecast. The revisions indicate that the economy grew slightly faster in the years following the pandemic than previously estimated, in both real and nominal terms. As a result, the revisions would have raised the starting level of GDP in our forecast.

The Blue Book revisions raised the level of nominal GDP in the second quarter of 2024 – the starting point of our forecast – by 1.2 per cent. This reflects upwards revisions to growth in both real GDP and the GDP deflator. Cumulative real GDP growth since 2020 was revised up 0.5 percentage points, driven by higher growth in transport, professional, and business support services industries. Cumulative growth in the GDP deflator over the same period was revised up 0.7 percentage points, underpinned by upwards adjustments to the government consumption deflator and the terms of trade. The revisions were primarily concentrated in 2022, with nominal GDP growth revised up 0.8 percentage points. Nominal growth in 2023 was increased by 0.4 percentage points but this was mainly due to the base effects of the revisions to growth in 2022. And with little change to growth in 2024, the revisions provide limited new information on current economic momentum or inflationary pressures. Therefore, they would not have materially impacted our forecasts for GDP growth and inflation had we been able to include them.

Chart C: Nominal GDP

For the public finances, growth in nominal GDP can provide useful insight into developments in the size of the tax base. In outturn, the upward revision to the historical level of nominal GDP would not in and of itself affect our receipts forecast because it would offset in a correspondingly lower effective tax rate. The jumping off point for the receipts forecast also benefits from more timely receipts data that is less prone to revision. For all fiscal aggregates, the higher level of nominal GDP will only have a purely arithmetic effect by mechanically lowering metrics as a share of nominal GDP. In Chapters 4, 5 and 6 we note the implications of the upward revision in 2023-24 if this were applied throughout all years of the forecast.

This box was originally published in Economic and fiscal outlook – October 2024