Box sets » Economic and fiscal outlook - October 2024

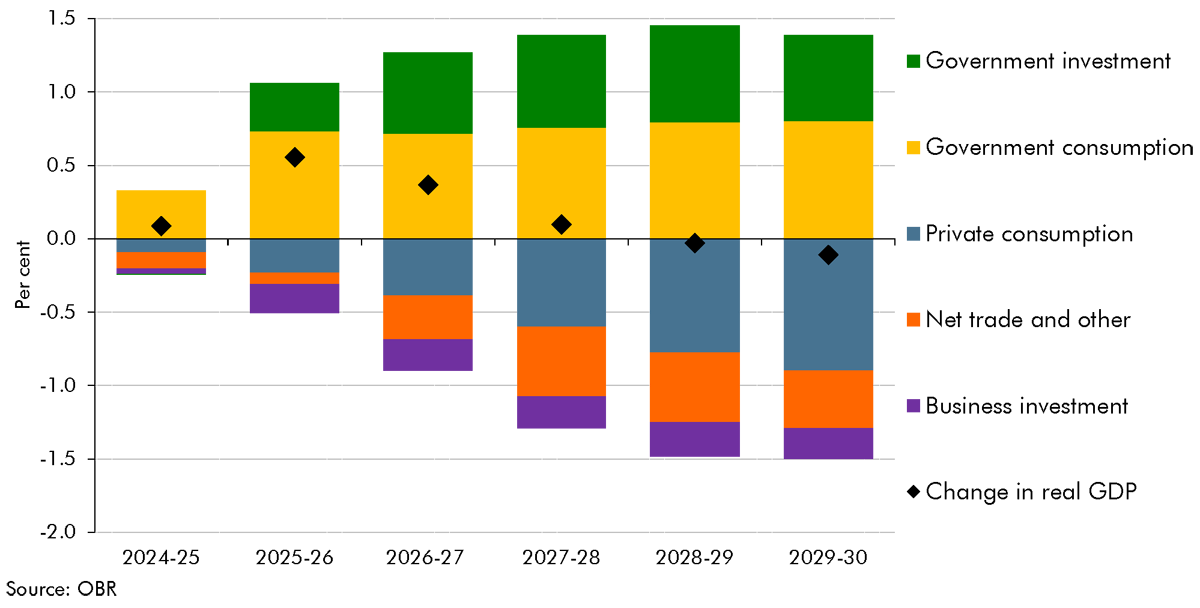

In each Economic and fiscal outlook we publish a box that summarises the effects of the Government’s new policy measures on our economy forecast. These include the overall effect of the package of measures and any specific effects of individual measures that we deem to be sufficiently material to have wider indirect effects on the economy. In our October 2024 Economic and fiscal outlook, we adjusted our forecast to account for fiscal loosening and considered the effects of changes to taxation and increases in public investment.

As we finalised our pre-measures forecast on 26 September, our forecast did not include the Quarterly National Accounts released on 30 September 2024, which contained Blue Book 2024 consistent revisions. This box examined the potential implications that including the latest data may have had on our forecast. We judged that the data revisions would have provided limited new information on current economic conditions, leaving our economic and fiscal forecast broadly unchanged.

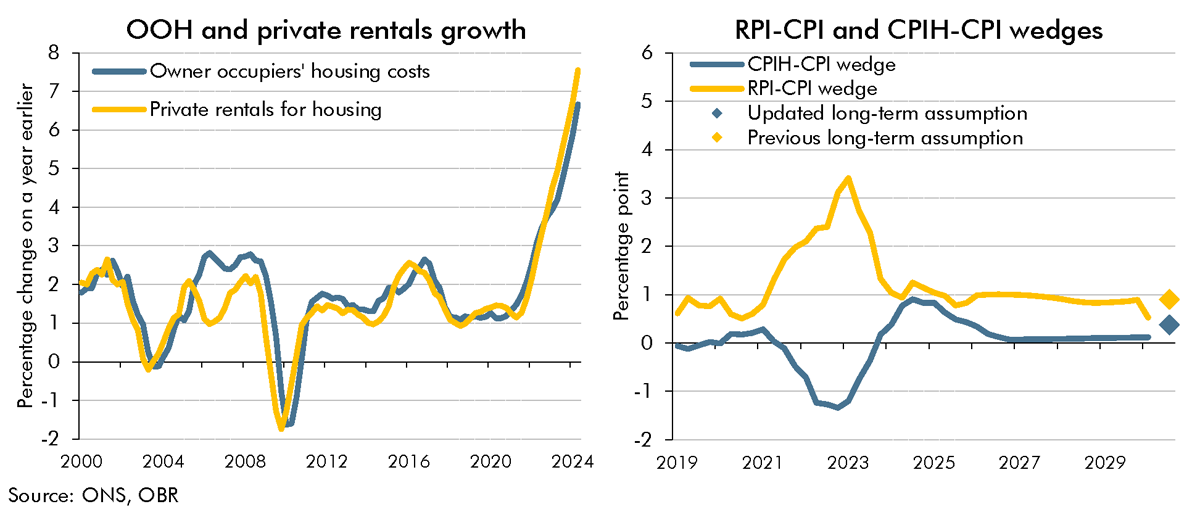

As as result of the shortcomings with the methodology for calculating the Retail Prices Index (RPI), the ONS's current plans are to address these by bringing the methods and data sources from the Consumer Prices Index including owner occupiers' housing costs (CPIH) into the RPI in February 2030. In this box, we explained how this change would impact our estimate of the long-run difference between RPI and CPI inflation.

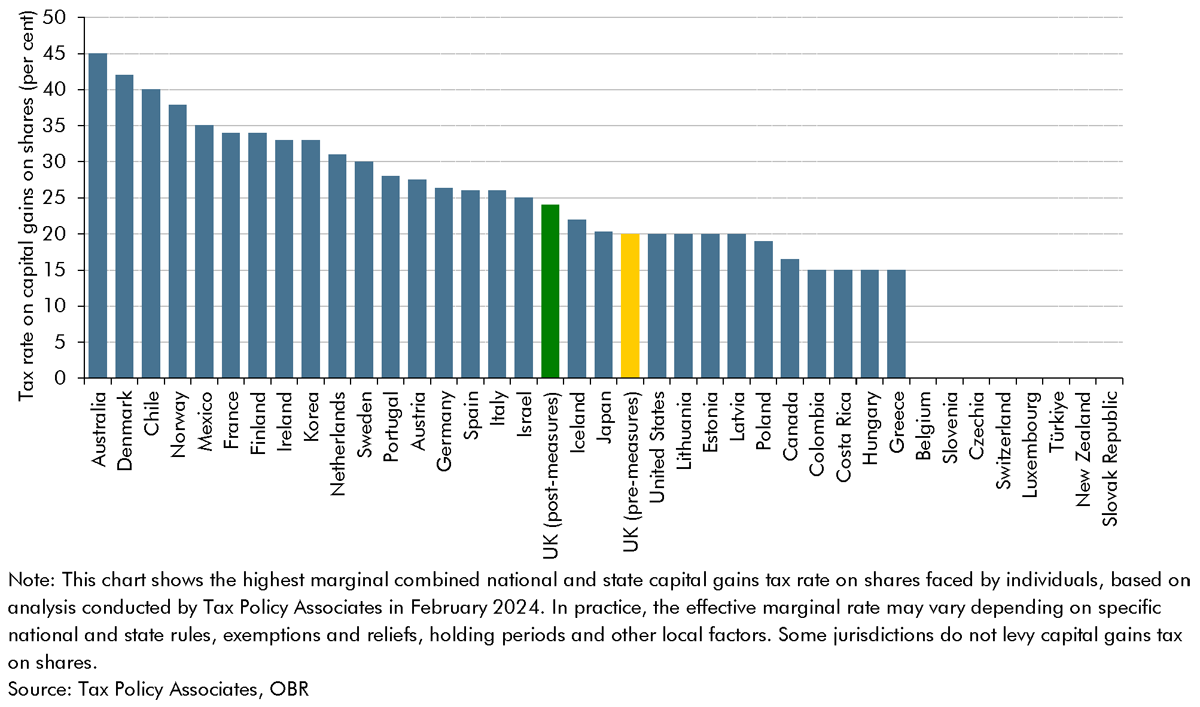

The capital tax measures announced in the October 2024 Budget affected an overlapping set of taxpayers and tax bases, mainly across capital gains tax, inheritance tax and income tax. In this box, we considered how individuals can respond to an increase in a capital tax liability, and what we assumed about these behaviours in our costings for capital tax measures.

The OBR, the Treasury, HMRC, DWP, DfE and DHSC have established a set of monitoring and evaluation arrangements for the 13 policies for which impacts have been explicitly incorporated in our potential output forecast as indirect effects since the Spring Budget 2023. In this box, we provided an update on monitoring and evaluation of these policies, and used the new evidence to assess how implementation and delivery align with our original judgements for indirect effects across the forecast horizon, culminating in a downward revision to labour supply in 2028-29 of 0.04 per cent.

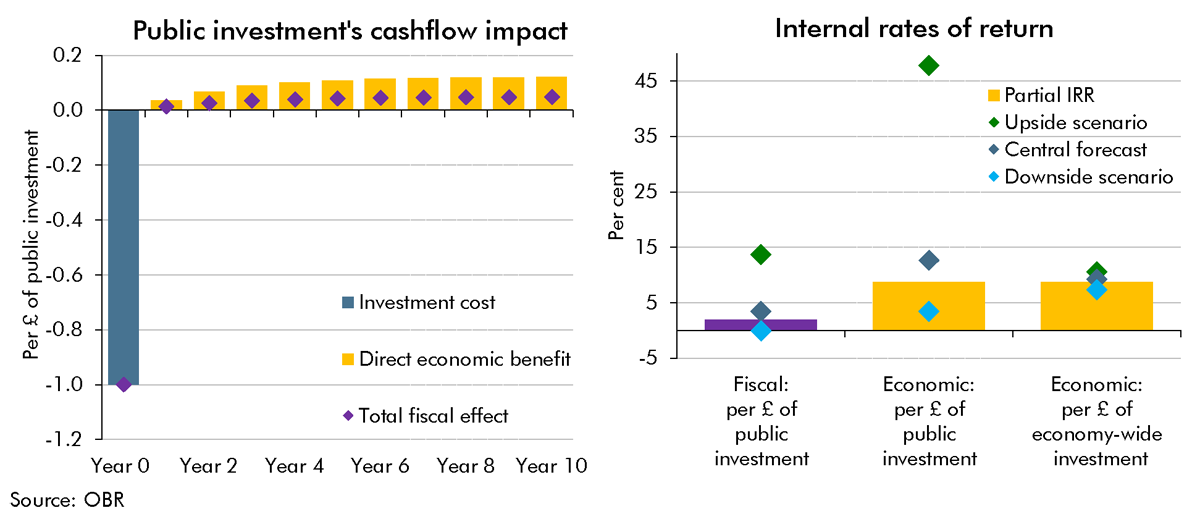

A key uncertainty around the long-run impact of the Budget's plans for higher public investment is the extent to which the public capital stock is a complement to (or substitute for) business investment. This Box provided scenarios in which the future business capital stock was higher or lower than we had assumed in our central forecast. We showed these scenarios' impacts on potential output in 50 years' time and the implications they had for different measures of the internal rate of return on investment.