The world price of oil increased sharply in 2010, reflecting rising world demand and unrest in the Middle East and North Africa. This box explored the impact this had on our public finances forecast at the time, from higher North Sea oil and gas revenues to the second round effects stemming from higher inflation.

The world price of oil has increased sharply since November, reflecting rising world demand and the unrest in the Middle East and North Africa. As explained in Box 3.2 in Chapter 3, this has contributed a reduction in our forecast of UK GDP growth of 0.2 per cent in 2015-16.

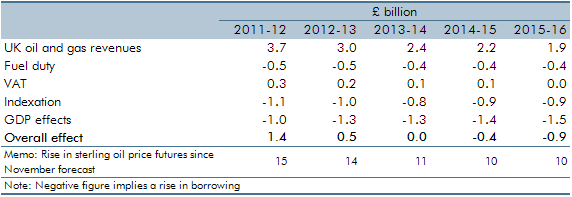

Changes in the oil price affect the public finances through a number of different channels. These were explored in detail in the interim OBR’s Assessment of the effect of oil price fluctuations on the public finances published in September 2010. Table A shows the approximate effect of higher oil prices on our current public finances forecast, which is broadly consistent with the September analysis. In the September paper, the interim OBR used the example of a £10 increase in the price of oil. Since November the oil futures curve which we use to base our projections has increased by £15 in the short-term and £10 in the medium-term.

In the current forecast the £15 increase in the oil price improves the public finances by around £1½ billion in 2011-12. Tax revenues from the UK oil and gas sector and VAT on fuel duty is increased by around £4 billion in 2011-12. This is only partly offset by:

- reductions in fuel duty, as higher oil prices reduce demand for fuel;

- indexation effects, as higher inflation leads to higher social security and debt interest payments; and

- economy effects, as higher inflation reduces real income and consumption leading to lower income tax and wider VAT receipts.

Over the forecast period, the overall effect on the public finances is broadly neutral, with an overall increase in borrowing in 2014-15 and 2015-16. The increase in revenues from the North Sea is lower in the medium term as the increase in oil prices since the November forecast is lower and because North Sea production is expected to fall over the medium term. In addition, the GDP effect is slightly higher in the medium term.

The September paper highlighted the uncertainty around the estimates and this is clearly also the case for our forecast projections. The medium-term oil price and its overall impact on the economy are highly uncertain, as are the projections of future North Sea oil production.

Table A: Estimated impact of higher oil prices on public sector net borrowing