Ahead of our March 2017 Economic and fiscal outlook, self-assessment tax receipts indicated that the Summer Budget 2015 reforms to the taxation of individual dividend income had prompted even greater income shifting than we had expected. The reforms raised the basic, higher and additional rates by 7.5 percentage points from April 2016 and introduced a tax-free allowance on the first £5,000 of taxable annual dividend income. They were pre-announced, giving taxpayers around eight months to bring forward dividend income into 2015-16 so that it was taxed at the lower rate. This box considered the amount of income brought forward and the effect of that on tax receipts.

This box is based on HMRC personal income taxes data from February 2017 .

In its July 2015 Budget, the Government announced reforms to the taxation of individual dividend income, raising the basic, higher and additional rates by 7.5 percentage points and introducing a tax-free allowance on the first £5,000 of taxable annual dividend income (cut to £2,000 in this Budget). These came into effect in April 2016, giving those affected a period in which to bring forward dividend income into 2015-16 so that it was taxed at the lower rate. Dividends are subject to income tax (with the same thresholds but different rates) mainly via self-assessment (SA), so 2015-16 liabilities were mostly paid in January and February 2017.

The original costing estimated that £7.6 billion of income would be brought forward to 2015-16, about two-thirds of this by additional rate taxpayers with incomes over £150,000. This estimate was based on HMRC’s evaluation of forestalling that occurred with the introduction of the 50p rate in 2010-11 (where around £18 billion of income was brought forward into 2009-10, mostly dividends). The estimate was adjusted for the distribution of those affected, the relative change in the tax rate and the assumed responsiveness of taxpayers to rate changes. Dividend income is typically much easier to bring forward than other types of income as the majority of it is received by owner-directors of companies who have freedom over when to withdraw their profits.

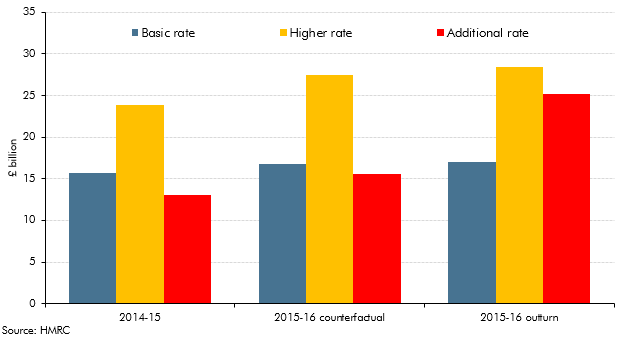

Preliminary HMRC analysis of 2015-16 SA returns suggests that forestalling of this change was underestimated by a significant amount. It is now estimated that £10.7 billion of dividend income (around 40 per cent more than originally predicted) was brought forward into 2015-16. This estimate is sensitive to the choice of counterfactual for dividend income growth in 2015-16 if no rate change had taken place. Dividend income (particularly from high earners) has been subject to frequent episodes of income shifting ahead of pre-announced tax changes in recent years, which makes it particularly difficult to choose an appropriate counterfactual. We have used different historical averages for basic, higher and additional rate taxpayers and assumed growth rates of 7, 15 and 20 per cent on a year earlier respectively. Regardless of the precise counterfactual chosen, Chart C shows that additional rate taxpayers reported a much bigger rise in 2015-16 dividend income than higher or basic rate taxpayers.

Chart C: Dividend income by taxpayer marginal rate – counterfactual and outturn

While the shifting of dividend income has clearly had a bigger effect on 2016-17 SA receipts than expected, considerable uncertainty remains over the effect on future years from which income has been shifted. A taxpayer who took twice their normal dividend income in 2015-16 might be expected not to withdraw further income in 2016-17, while someone taking three times their normal income might take two years to unwind. By comparing the growth in dividend income between 2014-15 and 2015-16 for each taxpayer, HMRC has estimated that around 80 per cent of the unwinding will take place within the first year, slightly more than first predicted.

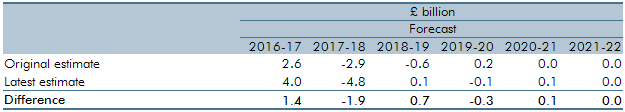

Table B: Effect of dividend income forestalling on tax receipts

On the basis of the counterfactual we have used, our latest estimate is that dividend income shifting increased 2016-17 SA receipts by £4.0 billion (higher than the initial estimate of £2.6 billion) but will reduce future receipts by £4.8 billion. This implies that pre-announcing the policy allowed taxpayers to reduce their bills by around £0.8 billion at the same cost to the Exchequer. HMRC analysis suggests that around one pound in seven of that saving benefited just 100 individuals who were able to withdraw dividends averaging £30 million each from their companies before the higher tax rate took effect.

This box was originally published in Economic and fiscal outlook – March 2017