In October 2021 commentators became increasingly concerned that the inability of supply to keep up with demand in specific areas of the economy would hold back the recovery. In this box we examined these 'supply bottlenecks' in energy, product and labour markets, discussing their consequences for wage and price inflation.

This box is based on Datastream, investing.com and ONS data from September and October 2021 .

In normal circumstances, markets are relatively efficient at bringing the supply of labour, goods, or services into line with demand. However, even relatively well-functioning markets can

experience temporary shortages, or ‘supply bottlenecks’, either because of adverse shocks to firms’ supply capacity or their inability to respond quickly to sudden changes in demand. The

latter – ‘demand-driven bottlenecks’ – can be particularly severe when there is an inelastic supply of essential inputs, constraints on prices, or factor market rigidities that prevent labour and capital from moving. Signs of shortages can also prompt amplifying ‘panic’ buying and stockpiling, while bottlenecks can also be ameliorated or aggravated by policy interventions.

As elsewhere, the post-pandemic UK recovery is being held back by various bottlenecks:

- In energy markets, a combination of depleted European gas reserves after last year’s cold winter, increased demand from China, unresponsive gas supply from Russia and disruptions to renewable energy supply, has pushed wholesale gas prices to historic highs. The Government’s price cap has prevented energy providers from passing most of this price increase onto consumers, resulting in failures among smaller energy providers who purchase gas on the spot market. High prices are also putting pressure on energy-intensive businesses, such as steel, glass, and chemical production, that are not protected by the price cap.

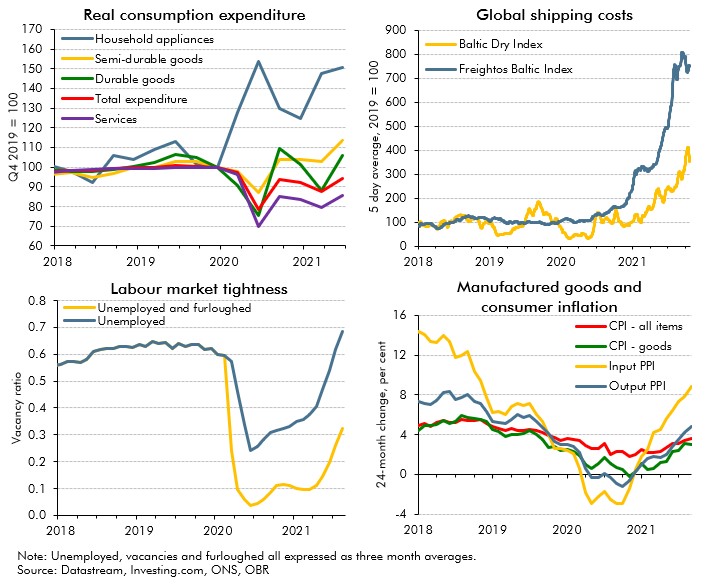

- In product markets, a surge in demand for imported goods in Europe and North America has bumped up against supply constraints in Asia. Demand for durable goods related to home working, including household appliances and computers, increased during the pandemic and remained significantly above pre-pandemic levels in the second quarter of 2021 (top left panel of Chart D). Sources of supply constraints include: coronavirus outbreaks in key manufactured goods exporters in Asia; an inelastic supply of key components, such as semiconductors; and logjams at key ports driven by logistical constraints, leading to sharp rises in shipping costs (top right panel of Chart D).

- In labour markets, shortages have arisen due to a combination of shocks to labour supply and mismatch between labour supply and demand. Shocks to labour supply are most evident in the market for heavy goods vehicle (HGV) drivers, where a 13 per cent fall in the number of drivers in the two years to June 2021 has been exacerbated by both delays in the certification of new drivers over the past year and post-Brexit limits placed on the hiring and utilisation of qualified drivers from the EU. Vacancies have risen rapidly compared to unemployment across the economy, indicating a tighter labour market, though labour market conditions will depend on what proportion of those on furlough in August return to their jobs (bottom left panel of Chart D). There is also evidence of mismatch in the sectoral and geographic compositions of labour supply and demand, discussed further in Box 2.2.

Chart D: Shifting demand and bottlenecks to supply are impacting prices

These bottlenecks have contributed to rising wages in occupations where workers are in short supply. For example, data from the online job search platform Indeed show that between January and September 2021 the median annual salary in postings for HGV drivers rose 19 per cent, versus just 1.3 per cent in the wider jobs market (adjusted for compositional changes).a The ONS estimates that in the most recent data for June to August 2021, adjusting for composition and base effects, regular earnings grew between 4.1 and 5.6 per cent, only slightly above average growth of 3.6 per cent in 2019. Despite shortages in some occupations, the Institute for Fiscal Studies finds that for most unemployed workers competition for jobs, defined as the number of available jobseekers per vacancy, adjusted for jobseekers’ occupational background, is more intense than before the pandemic.b

Bottlenecks have also contributed to higher consumer price inflation, as firms raise prices to reflect higher input costs (bottom right panel of Chart D). Data for the three months to September (to avoid the distortions from annual base effects) reveals that price increases have originated mainly in sectors subject to product market bottlenecks (such as industrial and durable goods, and vehicles). But inflation increases have been broadly based across subsectors, and we expect inflation to rise further, as recent energy price rises and labour market shortages add to input cost pressures. Our inflation forecast is discussed in more detail from paragraph 2.86.

This box was originally published in Economic and fiscal outlook – October 2021