An additional rate of income tax of 50 per cent for incomes over £150,000 was introduced in April 2010. Budget 2012 announced that this rate would be reduced to 45 per cent from April 2013. This box set out how the Budget 2012 measure was costed, in particular the assumptions we made around behavioural responses and income shifting. Box 3.2 of our 2014 Forecast evaluation report reviewed this costing in detail.

The previous Government announced in Budget 2009 that it would tax incomes above £150,000 at 50 per cent from April 2010. The Chancellor has now announced that this ‘additional rate’ will be cut to 45 per cent from April 2013.

The Government’s decision requires us to judge whether its costing of this measure in the Budget is reasonable and central, and hence whether this or an alternative costing should be incorporated in our forecast. For consistency, we have also re-examined our baseline tax receipts forecast, as the final pre-implementation costing of the 50 per cent rate in the March 2010 Budget was implicitly carried forward into subsequent OBR forecasts.

The costing of the 50 per cent rate

The March 2010 Budget estimated that the 50 per cent rate would raise an additional £2.6 billion of tax in 2012-13 on a liabilities basis (updated to £2.7 billion in the June 2010 Budget forecast). It assumed that the 300,000 individuals likely to be affected would be liable to an extra £7.5 billion in tax in the absence of any change in behaviour, but that £4.9 billion of this would never materialise as they took steps to reduce their taxable income. These steps might include labour supply responses (e.g. working less, taking a lower paid job, retiring early, or leaving the country) or greater recourse to tax planning, avoidance and evasion. The increase in the tax rate might also affect the willingness of high earning individuals based abroad to move to the UK and pay tax here.

Estimating the size of such behavioural responses is very difficult, especially for high-income individuals who are likely to be more willing and able to alter their working lives and financial arrangements in response to tax changes than the bulk of the population. The overall size of the behavioural response can be captured by estimating the Taxable Income Elasticity (TIE), the overall responsiveness of total taxable incomes to changes in marginal tax rates. The March 2010 costing used a TIE of 0.35, implying that the introduction of the 50 per cent rate would cut the total taxable income of the affected taxpayers by 5.9 per cent.

The most relevant alternative estimate at the time was produced by Mike Brewer, Emmanuel Saez and Andrew Shephard, for the Mirrlees Review at the Institute for Fiscal Studies in 2008. Based on responses to marginal rate cuts in the 1960s, 1970s and 1980s, they estimated that the TIE for the highest income 1 per cent of the UK population was around 0.46, implying that the introduction of the 50 per cent rate would reduce taxable income by 7.7 per cent. This would reduce the expected yield from the 50 per cent rate, although the authors have consistently emphasised the uncertainties around their number and all such estimates.

HMRC have now undertaken the first ex post analysis of the 50 per cent yield, based on 2010-11 self-assessment tax returns. One striking finding is that high-income individuals appear to have shifted at least £16 billion of income that would have been taxed in future years into 2009-10 so that it would be taxed at 40 per cent rather than 50 per cent. This has a one-off cost to the Exchequer of around £1 billion. The scale of forestalling, which was not factored into the March 2010 Budget costing at all, illustrates how willing and able high-income individuals are to adjust their behaviour in response to changes in tax rates.

Using a methodology broadly consistent with that of Brewer et al, and adjusting for forestalling, the HMRC study also suggests that the underlying behavioural response to the 50 per cent rate has been more powerful than the March 2010 Budget costing suggested. It points to a TIE around or above the Brewer et al level and significantly higher than 0.35.

In its costing of the move to a 45 per cent rate, the Government has assumed a TIE of 0.45 – broadly in line with the Brewer et al estimate. We believe that this is a reasonable and central estimate, both for the costing and for our underlying forecast. Taken at face value the HMRC study might suggest an even higher TIE, but this would risk placing put too much weight on a single year’s outturn evidence – especially given the complications from disentangling the forestalling effect. There is also reason to believe that the behavioural response to the cut in the tax rate may be smaller than to the increase, because of the costs involved in swiftly reversing expensive decisions on retirement, migration, tax planning and evasion. But it is very important to emphasise the significant uncertainties around all such estimates.

Implications for our baseline revenue forecasts

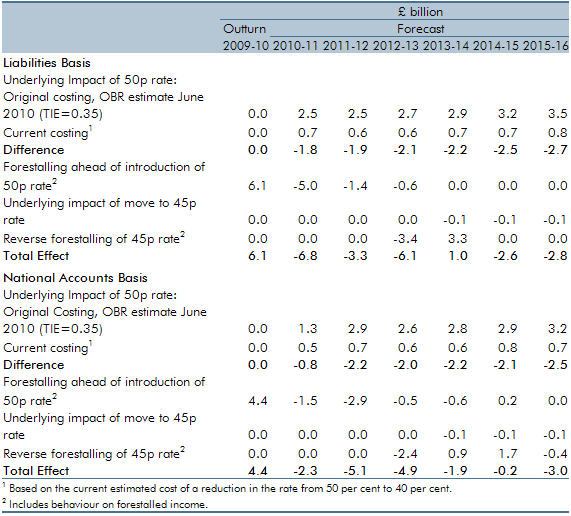

In addition to costing the rate cut, we need to re-examine our baseline pre-measures forecast to ensure that it reflects the latest evidence on the scale of forestalling and the strength of the behavioural response to the 50 per cent rate. Table A shows how these elements, plus the impact of the rate cut, have contributed to changes in our income tax forecast since the 50 per cent rate came in.

As regards forestalling, we conclude from the HMRC study that the shifting of income into 2009-10 probably increased tax liabilities in that year by around £6.1 billion, and would reduce them by £5.0 billion in 2010-11, £1.4 billion in 2011-12 and £0.6 billion in 2012-13. The scale of this behaviour in 2010-11 helps explain why self-assessment receipts have been so much weaker in January and February this year than we assumed in our November forecast.

Turning to the underlying impact of the 50 per cent rate, excluding the impact of forestalling, the HMRC analysis now suggests that it would raise £0.6 billion on a liabilities basis in 2012-13 rather than the £2.7 billion implied by the June 2010 Budget. (Based on the current estimated cost of cutting the rate back to 40 per cent. Re-estimating the cost of increasing the rate from 40 per cent to 50 per cent with the same TIE would give a higher figure). The amount of income subject to the 50 per cent rate is only slightly lower than that estimated in the June 2010 Budget and so this change in the costing very largely reflects the assumption of a stronger behavioural effect and a TIE of 0.45.

An added complication comes from the need to adjust these estimates on to a National Accounts basis. Budget policy costings and our forecast are both prepared on a National Accounts basis, which allocates most income tax receipts to years on an accruals basis (i.e. when the liability arises), but which allocates self-assessment receipts on a cash basis (i.e. when the money reaches HMRC). Most self assessment receipts come in nine months after the end of the tax year in which the liability was incurred. On a National Accounts basis the underlying costing of the 50 per cent rate in 2012-13 falls from £2.6 billion in the June 2010 Budget to £0.6 billion (again based on the current estimated cost of cutting the rate back to 40 per cent).

The lower expected yield from the 50 per cent rate has already manifested itself to some extent in lower-than-expected PAYE receipts during 2010-11, which would have been picked up (but not attributed to this explanation) in earlier EFOs. The HMRC analysis implies that we can now attribute £2 billion of the decline in our National Accounts receipts forecasts for 2012-13 since the 50 per cent rate was introduced to a reduction in the assumed underlying tax liabilities from the 50 per cent rate and £0.5 billion to forestalling.

The original Budget costings of the 50 per cent rate may also overstate the additional revenue generated because the labour supply response will affect disposable income, consumer spending and indirect tax revenues. There may also be similar effects in response to the reduction in the additional rate. We have not made any adjustment to our economic forecast for such effects. As Box 3.1 in Chapter 3 explains there are a number of measures in the Budget that could increase real household disposable income and consumption but also a number of measures that could reduce them, and we judge that the overall net effect is likely to be small.

The costing of the move to 45 per cent

Turning to the costing of the move to 45 per cent, measured against our baseline that reflects the new information on the 50 per cent yield, we have endorsed as reasonable and central the Government’s estimate that the underlying cost would be around £0.1 billion in 2013-14, based on an assumed TIE of 0.45. The figure is as low as this because a TIE of 0.45 implies that the revenue-maximising additional tax rate is around 48 per cent. Moving from just above to just below this rate would therefore have very little revenue impact. Moving the additional rate back to 40 per cent would take it further below the revenue maximising rate and would thus be more expensive at roughly an additional £500 million. But for the reasons set out above we would again emphasise the huge uncertainties here.

The Government has decided to implement the move to 45 per cent from April 2013. As we have seen, this will create an incentive to shift income between years to take advantage of the lower tax rate. The Budget costing and our forecast assume that around £6.25 billion of income will be shifted from 2012-13 into 2013-14 and that there will be a further small boost to taxable income in 2013-14 thanks to the underlying behavioural effect. This would reduce tax liabilities by £3.4 billion in 2012-13 and increase them by £3.3 billion in 2013-14, at a one-off cost to the Exchequer in the range of £100-200 million, though this is again uncertain.

Table A: Impact on income tax forecast of cut in additional rate plus re-costing of original additional rate

Conclusion

The assumption that the behavioural response to the 50 per cent rate is more powerful than the original costings assumed means that the cut to 45 per cent appears less expensive than it would have done under the original assumptions. Indeed at £0.1 billion it appears very inexpensive because 45 and 50 per cent are very close and either side of the implied revenue-maximising additional rate. But it is important to remember that the reassessment of the 50 per cent yield has a much bigger impact on the revenue forecast than the direct cost of the cut in the rate to 45 per cent. We now believe that overstatement of the original yield accounts for around a £2.5 billion reduction in our underlying National Accounts income tax forecasts by the end of the forecast horizon. A weaker behavioural response and a lower TIE would make the cut in the rate to 45 per cent more expensive and would reduce the downward impact on the baseline revenue forecast.