HMRC includes provisions in its accounts to cover risks from litigation cases where the tax at risk is greater than £100 million. This box highlighted the relationship between HMRC provisions, the amounts actually utilised and how this related to the July 2015 OBR forecast for likely tax litigation costs.

This box is based on HMRC tax litigation provision data from July 2015 .

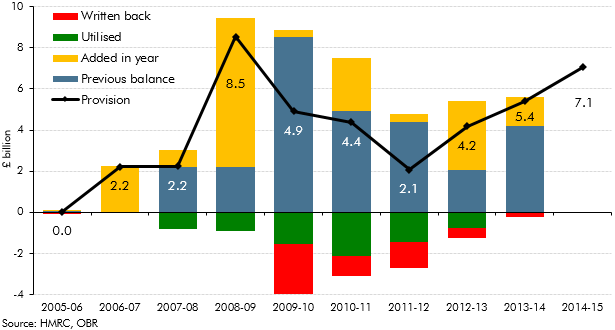

HMRC includes provisions in its accounts to cover risks from litigation cases where the tax at risk is greater than £100 million. The provisions cover cases where HMRC believes it is probable a settlement payment will be required and when the amount can be reliably estimated. It is expected these provisions will typically be paid out over a five-year period although, given the drawn out nature of this type of litigation, there remains a significant degree of uncertainty over when the final settlement will be made. Provisions increased from £2.1 billion in 2011-12 to £4.2 billion in 2012-13 and £5.4 billion in 2013-14.

Chart A: HMRC tax litigation provision

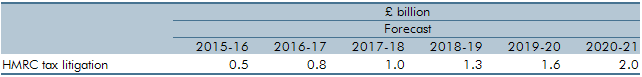

Chart A shows the relationship between HMRC provisions and the amounts actually utilised. We forecast a profile of payments against tax litigation cases, which is equivalent to HMRC’s amounts utilised. This has previously been included as negative tax, but we have now switched our forecast to capital grants in AME, consistent with ESA10 National Accounts guidelines. When provisions increased between 2005-06 and 2008-09, that was followed by an increase in the amounts utilised. Provisions fell between 2008-09 and 2011-12 and the amounts utilised fell back to a very low level. However, provisions started rising again in 2012-13 and we expect the upward trend to continue. Our forecast for 2014-15 provisions is £7.1 billion. So we also expect the amounts utilised to increase in the coming years from the very low level in 2013-14. Table A presents our forecast for this EFO. Given the uncertainty over the precise timing of settlement payments we have spread the amount across the forecast period on a gradually rising trend.

Table A: HMRC tax litigation costs forecast

This box was originally published in Economic and fiscal outlook – July 2015