Box sets » Receipts » Tax litigation

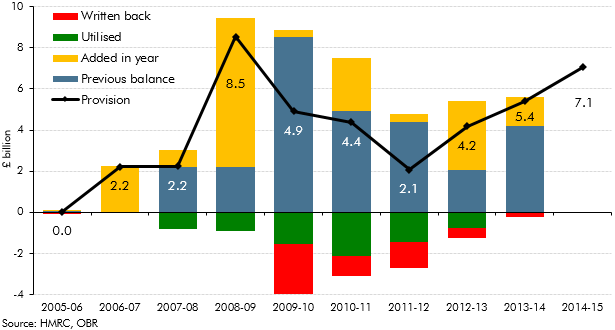

HMRC includes provisions in its accounts to cover risks from litigation cases where the tax at risk is greater than £100 million. This box highlighted the relationship between HMRC provisions, the amounts actually utilised and how this related to the July 2015 OBR forecast for likely tax litigation costs.