In 2013 the National Accounts measure of PSNB and PSND widened to include Bradford and Bingley and Northern Rock (Asset Management), and also included the APF transfers from the BEAPFF to central government. This box explained how the QE and APF transactions are treated in WGA and in the National Accounts, and the differences between them.

This Box explains how the QE and APF transactions are treated in WGA and in the National Accounts, and the differences between them. In last year’s FSR we reported that the WGA boundary had been widened for the 2010-11 WGA, so that it included the Bank of England and the Bank of England’s quantitative easing programme (QE). This year the WGA boundary has not changed, but, as explained in paragraph 2.8, the National Accounts measures of PSNB and PSND have widened to include Bradford and Bingley and Northern Rock (Asset Management) (NRAM), and also now include the APF transfers from the BEAPFF to central government.

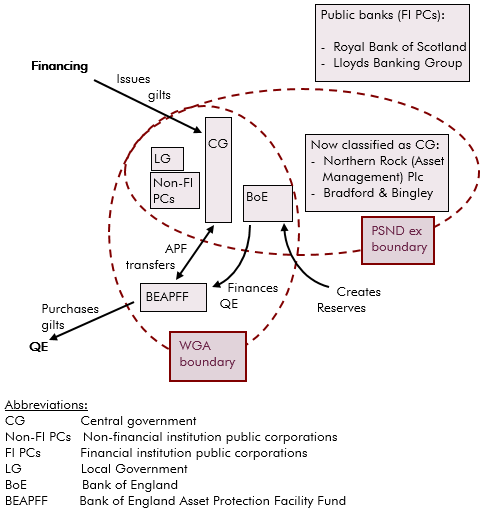

Chart A below shows the different boundaries that the WGA and National Accounts use to define the public sector. Both sets of accounts consolidate all the transactions within the public sector boundary, so that the only transactions that affect the final results are those which cross the boundary between the public sector and the wider economy. This means, for instance, that the government’s liabilities for net gilts issued are measured net of gilts held as assets by other bodies within the public sector.

Chart A illustrates how the financing of the central government net cash requirement and QE each work. Central government issues gilts (and other short term debt) into the market, to fully finance the central government net cash requirement. The BEAPFF implements decisions by the Bank’s Monetary Policy Committee and buys in gilts from the secondary market. These are separate processes.

Chart A also illustrates how the different boundaries for WGA and National Accounts produce different effects in relation to the QE and APF transactions:

- PSND includes the Bank of England, but does not include the BEAPFF. This means that PSND includes the loans that the Bank makes to the BEAPFF to finance QE, and the reserves which the Bank creates to finance those loans, which are treated as liquid deposits by commercial banks. These assets and liabilities are balanced and have little effect on PSND;

- this differs from net liabilities measured in WGA, which include the BEAPFF. The loans the Bank makes to the BEAPFF are consolidated out (since the lender and borrower are both within the WGA public sector boundary), but WGA include the gilts held by the BEAPFF as a result of QE, and the reserves which the Bank creates to finance the loans to the BEAPFF. This means that the WGA balance sheet shows lower net liabilities for gilts, since these are reduced by the BEAPFF’s holdings. WGA therefore shows the effect of QE as short-term financial liabilities (the Bank’s additional reserves) replacing the longer-term liabilities for gilts;

- WGA and the National Accounts also treat the APF transfers differently: in the WGA these transfers are all within the public sector and therefore net out to zero. But in the Public Sector Finance statistics, the transfers flow across the public sector boundary and affect PSNB.a However this difference will not show up until 2012-13, when the APF transfers began.

In our recent March EFO we estimated that the cumulative effect of these QE transfers might reduce PSND by roughly 2 per cent of GDP by 2022-23, when QE unwinding is assumed to end. But these estimates are highly uncertain.

Chart A: QE and APF transactions which cross the public sector boundary, as defined in the National Accounts and in the WGA