In each Economic and fiscal outlook we incorporate the impact of the policy decisions announced in the Chancellor’s Budget or other fiscal statement (the ‘fiscal event’). This box looked at how measures announced at the previous 16 fiscal events had tended to announce near-term giveaways but with the promise of takeaways in the later years. The Autumn Budget saw this pattern repeated.

One reason our borrowing forecasts change in each Economic and fiscal outlook is that we incorporate the impact of the policy decisions announced in the Chancellor’s Budget or other fiscal statement (the ‘fiscal event’). These include the tax and spending decisions reported on the Treasury’s ‘scorecard’ plus other changes – typically to departmental spending – that it chooses not to report in this way. There are typically lots of giveaways and takeaways in each event, the net effect of which is to raise or reduce borrowing in specific years and on average over the five years of the forecast – in other words to loosen or tighten fiscal policy.

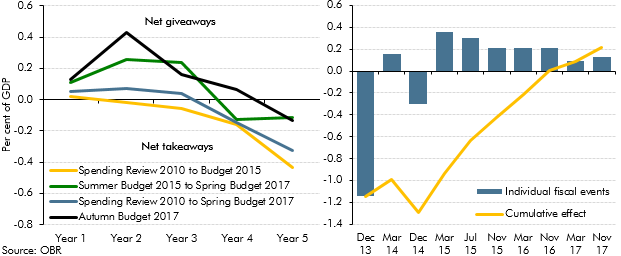

One pattern in the 16 fiscal events since the OBR’s first forecast at the Coalition Government’s June 2010 Budget is the ‘Augustinian’ tendency for governments to announce giveaways in the near term, but with the promise that the cost will be recouped by takeaways in the later years. Chart B shows the average tightening or loosening by year in all fiscal events from Spending Review 2010, and separately for each of the two previous Parliaments and this Autumn Budget. The pattern of early giveaways and later takeaways became clearer under the Conservative Government in the previous Parliament and has been repeated more forcefully in this Budget.

Chart C shows how the pattern of medium-term tightening followed by near-term loosening affects a given year as it draws closer and the early promises are superseded. When 2018-19 first entered the forecast window in December 2013, the Coalition Government pencilled in further cuts to spending as a share of GDP in that year. In the nine fiscal events since then, policy has been loosened in all but one. In cumulative terms, all the initial tightening had been offset by Autumn Statement 2016, with further loosening announced in both Budgets this year.

This switch from takeaways to giveaways did not occur because the underlying forecast for the public finances had improved in such a way that the earlier takeaways had proved unnecessary. Rather the Government has become less ambitious for net borrowing. In Autumn Statement 2013 the Coalition had set its spending plans consistent with achieving a structural budget surplus of 0.3 per cent of GDP in 2018-19. In this Budget the Government has loosened policy to the extent that the structural deficit is expected to be 1.8 per cent of GDP in that year.

Chart B: The average effect of Government decisions on borrowing (left) and Chart C: The effect of Government decisions on borrowing in 2018-19 (right)

This box was originally published in Economic and fiscal outlook – November 2017