This box set out the impact of changes in interest rates on our public finances forecast, including debt interest spending and income tax receipts. Updated versions of our ready reckoners can be found on our website.

Since the March EFO short term interest rates have fallen significantly, by an average of 200 basis points over the forecast period. This reflects the weaker outlook for the global economy, leading to market expectations that monetary authorities will keep interest rates lower for longer than we previously assumed. The fall in short-term interest rates has also fed through to longer-term interest rates, with gilt rates down an average of 170 basis points over the forecast period. In part this is also likely to reflect market perceptions that UK gilts are currently low risk relative to many euro area countries. Downward pressure on gilt rates may also have resulted from recent volatility in equity markets, which may have encouraged investors to hold safer assets.

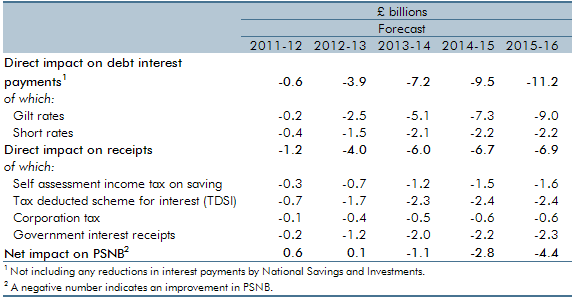

Lower short and long-term interest rates make it cheaper for the Government to rollover its existing debt and issue new debt. As Table shows, in this EFO we forecast Athat the lower paths of short and long-term interest rates reduce debt interest payments by £11 billion in 2015-16 compared to the March EFO.

However, the total impact on the public sector finances also depends on how lower interest rates affect receipts. Lower interest rates have direct effects on the incomes of individuals and corporations and therefore on government receipts. Compared to the March EFO we forecast that in 2015-16 as a result of lower interest rates:

- income tax receipts from self assessment saving income will be lower by £1.6 billion;

- income tax receipts relating to the tax deducted scheme for interest (TDSI) will be lower by £2.4 billion;

- corporation tax paid by businesses on their interest income will be lower by £0.6 billion; and

- interest earned by central and local government on their reserves and holdings of financial assets will be lower by £2.3 billion.

The total direct impact of lower interest rates in our forecast is to reduce receipts by £6.9 billion in 2015-16. The net improvement in the public finances as a result of lower interest rates since March is therefore £4.4 billion by 2015-16, around 60 per cent less than the improvement implied by lower debt interest spending alone.

A full assessment of how interest rates affect the public sector finances would also require us to consider indirect effects on receipts and expenditure. Changes in interest rates can significantly affect RPI inflation through their impact on mortgage interest payments (MIPs), and RPI inflation is then used in the uprating of income tax thresholds and allowances, the revalorisation of duty rates and affects the debt interest costs of index-linked gilts. Interest rates also help determine a range of economic variables, such as consumption and investment.

Table A: Effect of change in interest rates on the public finances