This box showed how growth in some of the key economy variables between 2010 and 2013 was lower when measured on a per capita basis. We also discussed our forecast for productivity growth at that time, given its importance in determining GDP per capita growth in the medium term.

This box is based on ONS GDP and employment and Bank of England GDP data from May 2013 and February 2014 respectively.

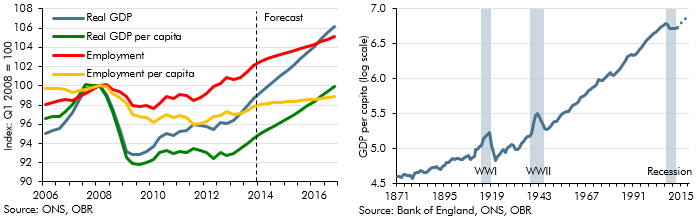

Since the beginning of 2010, real GDP has risen by around 5¼ per cent and 1.3 million more people are in work. But the population aged 16 and older has grown by 1.4 million and so GDP per capita on this basis has grown by just 2½ per cent, remaining 5½ per cent below its pre-crisis peak. Likewise, real per capita consumption has fared far worse than aggregate consumer spending and remains 5½ per cent lower than before the crisis. Similarly, while employment now exceeds its pre-crisis level, the proportion of the population employed does not.

Fundamentally, GDP per capita cannot be expected to grow sustainably unless productivity grows and productivity has been exceptionally weak in the recent past. We expect recent trends to become less dominant – population growth is forecast to slow and productivity growth to pick up. Chart A shows that we expect the economy to be bigger than it was before the crisis by mid-2014, but we do not expect GDP per capita to reach its pre-crisis peak until early 2017.

The uncertainty over this judgement is highlighted in Chart B, which shows that the recent persistent shortfall of per capita GDP is without peace-time historical precedent. It seems reasonable to us that the rate of productivity growth should return to historical norms, but, without the past as a useful guide, it is difficult to judge how long this might take.

Chart A: Real GDP and employmenta (left) and Chart B: Real GDP per capitab (right)

Even the judgement that efficiency improvements will resume is subject to extensive debate among external commentators. Some believe the financial crisis of 2008 coincided with a permanent slowdown in productivity growth, perhaps reflecting the exhaustion of ‘low-hanging fruit’ efficiency gains in the IT sector.c Others are more optimistic, assuming efficiency gains have continued apace but that weak demand is masking the process.d

Our central judgement lies between these two views. We expect productivity growth to return to its historical average as the pace at which resources are reallocated to more productive uses picks up, but with the level of productivity, and therefore per capita GDP, permanently lower relative to its pre-crisis trend. This judgement is subject to significant risks in both directions.