The household saving ratio captures both the disposable income that households do not spend on consumption, and changes in the equity households have in pension funds. This box described how the household saving ratio is calculated, and considered the relative contribution of pension and non-pension saving to the saving ratio over the preceding decade. The box also discussed possible factors behind recent movements in pension saving.

The household saving ratio is the proportion of disposable income that is not spent on consumption. However, this is not as straightforward a definition as its sounds because of the way in which contributions to pension funds and the interest and dividends earned by them are attributed to households.

In the National Accounts, changes to the equity households have in pension funds are driven by employer and employee contributions to pension funds. The employee contributions, in 2009, consisted of around £5 billion of direct payments and around £35 billion of interest and dividends accrued to existing pension assets. Employer contributions were around £48 billion. So the share of contributions to pension funds that might be considered an active part of household saving, was only around 7 per cent of the total in 2009.

In the National Accounts, saving is defined as:

disposable income – consumption + change in net equity in pension reserves

The saving ratio is defined as:

(disposable income – consumption + change in net equity in pension reserves)/(disposable income + change in net equity in pension reserves)

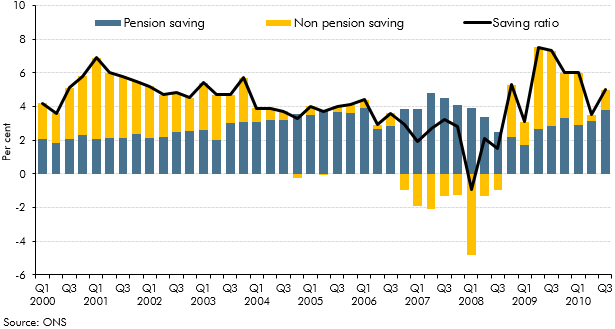

Because the change in net equity is a far greater share of the numerator than the denominator it can have a substantial effect on the saving ratio. To illustrate this, Chart A decomposes the saving ratio into contributions from pension and non-pension saving.a

Chart A: Pension and non-pension saving

One reason for the increase in pension saving from 2000 to 2006 was the need for firms to make special payments to make up shortfalls in defined benefit pension funds.b Over the course of the recession, these funds moved into surplus, decreasing required contributions at a time when employers were also under greater financial pressure. This explains some of the fall in the saving ratio. Over the same period, household non-pension saving also fell as households dipped into savings to smooth their consumption.

Recent movements in the pension saving contribution to the saving ratio will have been affected by the increased volatility of dividend payments and interest accrued by pension funds.