The Government has been piloting full business rates retention since 2017-18. These pilots featured in our forecasts from March 2017. This box reconsidered and re-estimated the fiscal effects of the 100 per cent local retention pilots scheme.

The Government has been piloting full business rates retention since 2017-18. These pilots have featured in our forecasts since March 2017, but were incorrectly incorporated as being fiscally neutral by definition, as they straightforwardly transferred spending from central government to local authorities. A reduction in central government DEL grants was assumed to offset an equivalent amount of locally retained business rates that financed higher LASFE.

A paper published in April by the Institute for Fiscal Studies (IFS) argued that the pilot schemes would in fact not be spending- or borrowing-neutral, but would instead result in a financial gain to local authorities and higher public sector net borrowing.a In light of this, we engaged with the Ministry of Housing, Communities and Local Government (MHCLG) and the Treasury to understand the significant differences between its conclusions and the estimates we had used in our forecasts. We established that the information that we had been provided regarding the way the pilots would operate and their potential fiscal effects was incomplete and in part incorrect. As a result, the fiscal costs of the pilots have been re-estimated and included in this forecast.

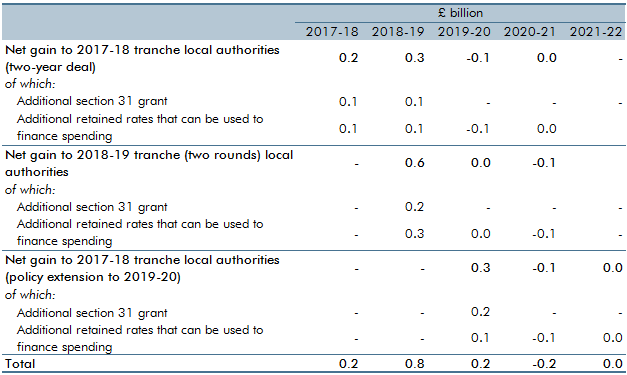

Table C summarises the estimated gains to authorities from the pilots that have been announced so far. The overwhelming majority of pilot authorities are expected to receive a net financial gain. Relative to a situation in which they had continued to retain 50 per cent of business rates, we expect pilot authorities to gain £0.8 billion in 2018-19, which aligns to the IFS estimate. The loss in 2020-21 reflects the fact that authorities tend to over-forecast business rates revenues in their budgets and we assume that this will result in larger deficits on collection in future years.)

Table C: Estimated financial gain to business rates retention pilot authorities

This box was originally published in Economic and fiscal outlook – October 2018