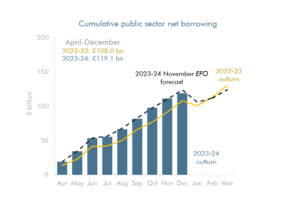

Year-to-date borrowing moves below our forecast

This morning’s ONS release shows that borrowing in the first nine months of 2023-24 totalled £119.1 billion, £11.1 billion above the same period last year. This is £4.9 billion below the monthly profile consistent with our November forecast, largely due to lower than expected inflation reducing debt interest payments.