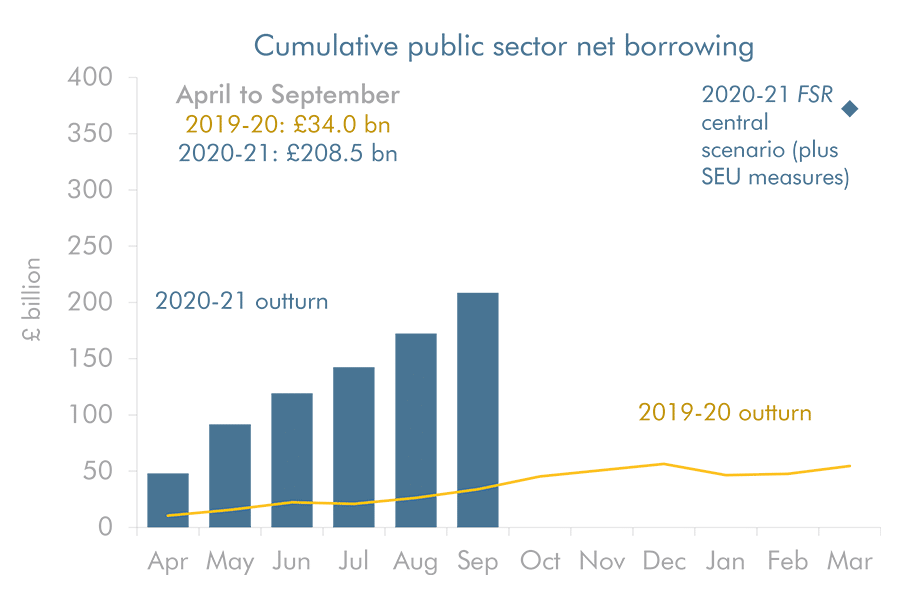

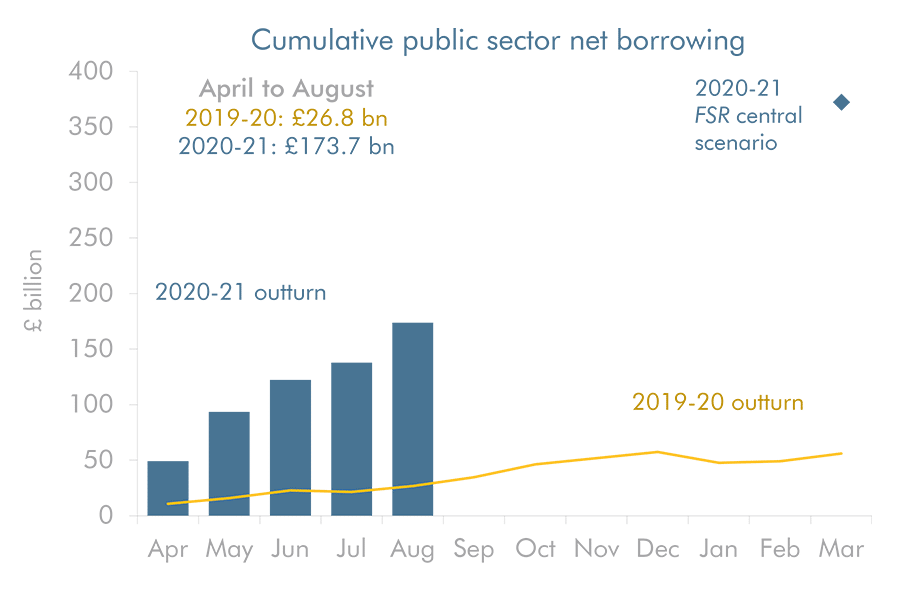

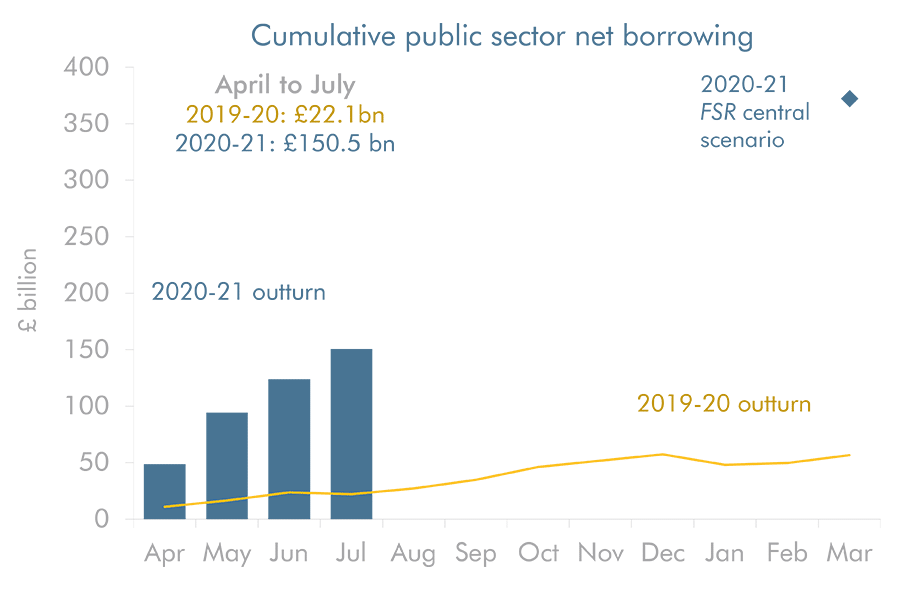

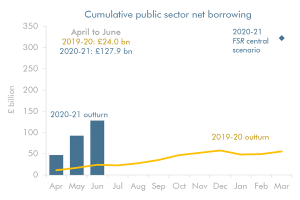

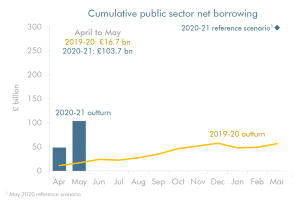

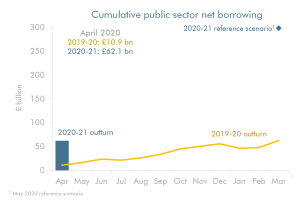

Budget deficit tops £200 billion in six months

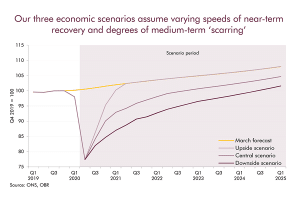

Halfway through the 2020-21 fiscal year, cumulative borrowing has reached £208 billion, £51 billion above full-year borrowing in 2009-10 (at the peak of the financial crisis). Year-to-date borrowing is still lower than assumed in the central scenario from our Fiscal sustainability report, as both GDP and tax receipts have fared better than assumed. But with a…