For a quick summary, read the overview

Commissioned by Parliament in 2015, the report identifies and analyses risks to the medium term outlook for the public finances and to long-term fiscal sustainability. It covers a wide range of topics including:

- macroeconomic and financial sector risks (Chapters 2 and 3)

- specific revenue and spending risks (Chapters 4 and 5)

- balance sheet and debt interest risks (Chapters 6 and 7)

- policy risks to the public finances, including the Government’s weakening commitment to its legislated balanced budget objective (Chapter 8)

- for the first time, how we might analyse possible risks to the public finances from climate change (Chapter 9)

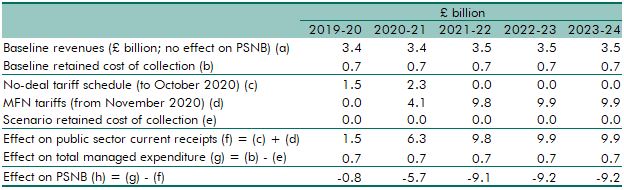

- a fiscal ‘stress test’ where we illustrate the fiscal effects of the International Monetary Fund’s ‘No-deal Brexit Scenario A’, which was published in the April 2019 World economic outlook, Scenario Box 1.1. (Chapter 10)

HM Treasury are legally committed to respond to our Fiscal risks report as outlined in the Charter for Budget Responsibility.