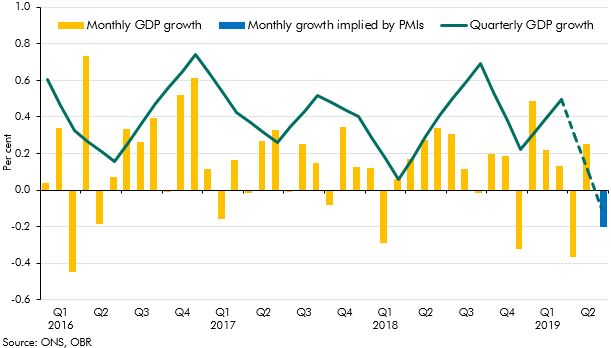

Monthly output data and the PMIs weakened in the second quarter of 2019, leading some commentators to suggest GDP would fall. This box considered what was behind the weaker data and whether it would persist into the third quarter, leading to a technical recession.

This box is based on ONS and HIS Markit/CIPS data from July 2019 .

History suggests there is around a one-in-two chance of a recession in any five-year period. The ONS estimates that GDP fell on a monthly basis in April, after weak growth in March, and only partly rebounded in May. The National Institute of Economic and Social Research’s (NIESR) monthly GDP tracker published on 10 July, which uses survey indicators and past trends in the data, suggests that the economy shrank by 0.1 per cent in the second quarter of 2019.a The all-sector purchasing managers index (PMI) readings for April to June are also consistent with GDP contracting by 0.1 per cent in the second quarter according to IHS Markit (Chart A).b So, does this foretell a full-blown recession? Or might transient factors be to blame?

If the ONS data released in August do show the economy shrinking in the second quarter, it is likely to be in part a ‘pay-back’ from the strength of Brexit-related stock building in the first quarter. Indeed, the 0.5 per cent growth in that quarter was more than explained by inventory accumulation. Manufacturing also grew strongly, which is consistent with businesses increasing stocks as a precaution against any potential disruption to supply chains. Higher stock building would have been growth-neutral if the goods being stockpiled were all imported, but it is possible that it boosted domestic output too, for example in the distribution and warehousing sectors, and exports might have benefited if EU firms stockpiled UK goods too.c The volatility of monthly GDP growth in April and May was driven by car production, as the car industry had brought forward planned annual maintenance shutdowns to coincide with Brexit and minimise any related disruptions, causing output to plummet in April and rebound in May. But manufacturing has also weakened globally, reflecting factors such as the introduction of tariffs by the US and China.

Chart A: Monthly and quarterly GDP growth

If Brexit-related factors were the only ones behind the relative strength of the first quarter and the possible contraction that followed, the economy might be expected to return to growth in the third quarter. But the PMI surveys were particularly weak in June, suggesting that the pace of growth is likely to remain weak. NIESR’s initial estimate for the third quarter is weak GDP growth of 0.2 per cent. Still, this suggests there is a risk that the economy could enter a technical recession (i.e. two consecutive quarters of falling output).

The fiscal risks associated with recessions depend on their depth and persistence, the sectors most deeply affected, and the pace at which the economy subsequently recovers. The stress test presented in Chapter 10 illustrates the fiscal consequences of a recession following a no-deal Brexit, consistent with a scenario published by the IMF earlier this year.

This box was originally published in Fiscal risks report – July 2019