A key issue in our welfare spending forecast is the transition to universal credit (UC) from the existing ‘legacy’ benefits and tax credits systems. In our March 2017 Economic and fiscal outlook, our central forecast was constructed by forecasting the ‘legacy’ system as though UC did not exist, then subtracting from it an estimate of the marginal saving associated with rolling out UC. This box presented estimates for actual gross spending in 2017-18 on UC and the legacy benefits and tax credits that it is replacing.

Our welfare spending forecast is constructed by forecasting the existing ‘legacy’ benefits system as though universal credit did not exist, then subtracting from it an estimate of the marginal saving associated with rolling out universal credit (UC).

This allows us to base the forecast on as much administrative data as possible, but it does not reflect what will happen in the real world, where spending on the legacy benefits will fall while spending on UC will rise. As the UC rollout proceeds, the real world and this approach will diverge further. As soon as is practical, we will switch to forecasting UC on a gross rather than marginal basis.

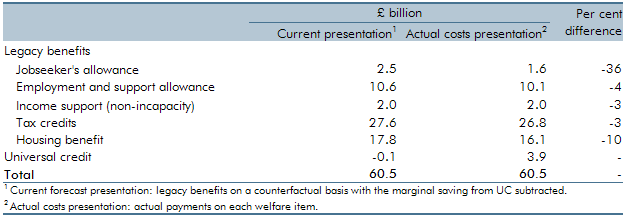

To facilitate monitoring of our forecast against the monthly outturn data over the coming year, Table D sets out estimates for actual gross spending in 2017-18 on UC and the legacy benefits and tax credits that it is replacing and compares that to spending in our ‘no UC’ central forecast. It shows that:

- (income-based) jobseeker’s allowance is £0.9 billion (36 per cent) lower than our ‘no UC’ forecast. This is the legacy benefit for which the real world has diverged from our forecasting approach most significantly. That also has implications for the claimant count measure of unemployment, where around a third of the claimant count is now made up of individuals in receipt of UC. The ONS has announced that the claimant could will be dropped from the monthly labour market statistical bulletin as it ceases to be a reliable indicator during the UC rollout;

- (income-related) employment and support allowance is £0.5 billion (4 per cent) lower than in our ‘no UC’ forecast;

- income support (non-incapacity) is £0.1 billion (3 per cent) lower than in our ‘no UC’ forecast;

- tax credits spending (including both working and child tax credit) is £0.8 billion (3 per cent) lower than in our ‘no UC’ forecast. Spending in 2016-17 has come in lower than expected, even after adjusting for the equivalent estimate of UC actual costs. Part of this may be explained by higher UC costs in relation to tax credit equivalent cases than we currently assume;

- housing benefit is £1.8 billion (10 per cent) lower than in our ‘no UC’ forecast. Actual costs related to in-work housing benefit equivalent cases may also be higher than we currently assume; and

- actual expenditure on UC is estimated to be £3.9 billion, £0.1 billion less than the sum of the lower spending on legacy benefits. This marginal saving reflects the fact that UC is less generous on average – particularly for tax credits equivalent cases and those who would have received disability premiums in the legacy system due to also receiving PIP. This saving will rise over time.

Table D: Universal credit expenditure in 2017-18

This box was originally published in Economic and fiscal outlook – March 2017