In Chapter 4 of our December 2014 EFO, we discussed the fiscal outlook for 2014-15 to 2018-19. In this box, we discussed the latest universal credit rollout plan following the 2014 universal credit business case. Whilst we agreed that the plan to fully rollout universal credit for jobseeker’s allowance cases by March 2016 was central, we decided that the migration plan for claimants of other legacy benefits was still highly uncertain and so implemented a six month delay to the plans for our forecast. This had the effect of reducing the volume of migrations in all years of the forecast but did not substantially alter the universal forecast given that it marginal to the legacy benefits.

This box is based on DWP universal credit data from December 2014 .

Since our March 2014 EFO, DWP and HMT have agreed a new business case for universal credit. This has also been agreed with HMRC and local authority representatives, while the plans were assured by the Major Project Authority (MPA). These plans include changes in the rollout schedule with the bulk of the rollout pushed back once again. The schedule is now:

- the pace of the rollout for JSA single cases has been increased slightly with full rollout across the country by March 2016;

- new claims to the legacy benefits are due to cease on a rolling geographical basis from May 2016 to December 2017 with the universal credit caseload growing naturally from when benefits are closed;

- managed migration of JSA, IS and HB claims will begin in January 2018 and last 24 months; and

- the managed migration of ESA and tax credits only cases will occur ‘at some point’ beyond the forecast profile.

We have considered the evidence on the centrality of these plans – including the cross-government scrutiny that has taken place – and have weighed that against the recent history of optimism bias in universal credit plans and other projects of this sort.

In our view, there remains considerable uncertainty around the delivery of such a complex and wide-ranging change. On the basis of the evidence we have reviewed, we judge that:

- the first part of the proposed schedule is central. Delivery risks have been reduced by the use of the existing ‘live service’ and we are reassured by the MPA’s assessment; and

- the second part of the rollout is more uncertain and we have assumed for this forecast that it will be delayed by a further six months beyond the new plans. The continuing delays in universal credit and elsewhere in ESA and PIP suggest it would be premature to assume that the digital solution will be ready on this timetable. The detailed MPA assessment on this part of the plan was less reassuring. The recent NAO report on universal credit also noted that “universal credit remains a highly ambitious and challenging transformation programme.”

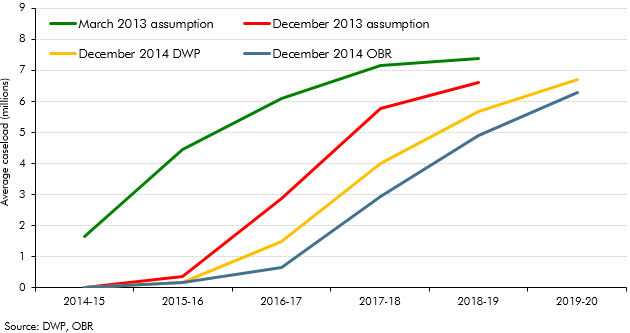

The evolution of the rollout plans for universal credit, including the DWP’s preferred profile and our central forecast is shown in Chart D.

Chart D: Changes to the universal credit rollout assumption

Compared to previous assumptions the combination of the move to DWP’s preferred profile and our 6-month delay to non-JSA cases has the effect of migrating about 2.2 million fewer people onto universal credit in 2016-17, 2.9 million in 2017-18, and 1.6 million in 2018-19 than in March, leaving some recipients of ESA and tax credits to migrate later. Despite these large changes in volumes, the impact on the welfare spending forecast is comparatively small since these changes only affect the marginal costs of universal credit.

There are of course broader uncertainties over the eventual cost of universal credit, including the behavioural response of potential claimants and the scope for error and fraud savings and the impact of the minimum income floor for self-employed claimants. We will continue to review progress against the design plans, as well as emerging evidence on the costs and savings.