Survey evidence suggested that firms were building inventories ahead of the UK's exit from the EU. In this box we considered prospects for stockbuilding and the implications for GDP growth.

This box is based on ONS data from February 2019 .

There is growing evidence that firms are building up inventories in preparation for any Brexit-related disruptions to supply chains. While official data provides only limited evidence of material stock building at the end of 2018, survey evidence suggests that some firms have been increasing their stocks since the start of this year.

The CIPS UK Manufacturing PMI reported very sharp rises in both purchasing activity and a record of stockpiling of inputs in February. The CBI industrial trends survey painted a similar picture, indicating a large planned increase in holdings of raw materials. These indicators are consistent with a recent survey by the Bank of England’s Agents, suggesting that an increasing number of companies are building stocks. Of the firms surveyed that were actively preparing for Brexit (around half of their sample), it was reported that around half were currently building inventories. Within manufacturing and services, almost two-thirds were stockbuilding. Around a fifth of companies said they were taking extra warehouse space.a

We forecast a further increase in the level of inventories in the first quarter of 2019. In the National Accounts, investment in inventories are a component of expenditure and therefore contribute to GDP growth. However, at the current juncture any rise in stocks is likely to be concentrated in imports from the EU. As a consequence, we expect the contribution of the additional increase in stockbuilding to GDP growth to be negligible.

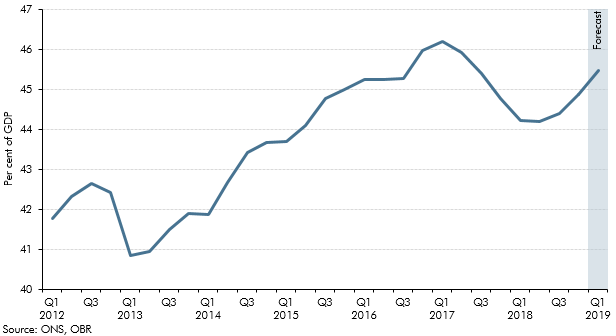

Chart A: Stock of inventories

This box was originally published in Economic and fiscal outlook – March 2019