The Government introduced several tax deferral policies in response to the pandemic in an attempt to mitigate the strain on businesses. This box provided an update of the impact of those policies, and the level of tax debt still owed.

This box is based on HMRC data from September 2021 .

In our July 2020 Fiscal sustainability report, we outlined the possible impacts of non-payment of tax liabilities on prospects for tax receipts, noting also that these effects were highly uncertain. The economic impact of the pandemic and the Government’s decision to suspend some debt collection led to a large increase in tax owed in the initial phase of the pandemic.

The Government introduced several authorised tax debt deferral schemes:

- The VAT deferral measure allowed companies to defer VAT payments from between 20 March and 30 June 2020 to 31 March 2021, while the VAT new payment scheme (NPS) allowed deferred VAT payments to be repaid in up to 11 equal monthly instalments extending into 2021-22. The latest data suggest that total VAT deferred stands at around £33.5 billion. Of that figure, £27.2 billion has been repaid, £10.2 billion by the 31 March deadline and £17.1 billion by the end of October. Most of the remainder is expected to be paid through the VAT NPS or through other arrangements. Our October 2021 forecast assumes the total cost of deferrals never repaid will be around £0.5 billion.

- The self-assessment (SA) deferral policy allowed payments due in July 2020 to be deferred until the end of January 2021. An estimated £6.6 billion was deferred, much lower than the £11.8 billion we initially expected. Much of this was paid on or before the deadline, so that the policy merely moved payments within the 2020-21 tax year. The additional SA self-serve time-to-pay measure announced in the Winter Economy Plan extended eligibility to allow those with up to £30,000 in tax debts to arrange a 12-month repayment plan online. Around 209,000 SA payment plans were set up for an estimated £1.3 billion in tax owed. Take-up was 90 per cent lower than we initially assumed. There appears to have been little non-compliance and few defaults, resulting in the total cost of the measure expected to be a modest £60 million.

There was also a sharp rise in unauthorised tax debt in the initial lockdown – i.e. some taxpayers delayed payments without first agreeing that with HMRC:

- PAYE tax debt increased significantly at the start of 2020-21, rising from just over £3 billion pre-pandemic to a peak of over £12 billion in May 2020. With companies receiving grants, business rates reliefs, government-guaranteed loans, and having some payroll costs covered by the CJRS, the debt balance fell back as employers’ finances were supported. HMRC estimates that almost 90 per cent of PAYE debts from April to August 2020 have been repaid. But PAYE debt over a year old has increased from approximately 7 per cent in April 2020 to 30 per cent in October 2021, which may be because pauses in debt collection led to older debt building up alongside new pandemic-related debts. Total PAYE tax debt remains around £5 billion (150 per cent) higher than pre-pandemic, with these older debts being slower to be repaid than the new ones.

- Other tax debts, including SA and VAT (excluding authorised deferrals) and corporation tax, have also seen increases in amounts outstanding. Total non-PAYE debt remains around £11.2 billion (80 per cent) higher than pre-pandemic.

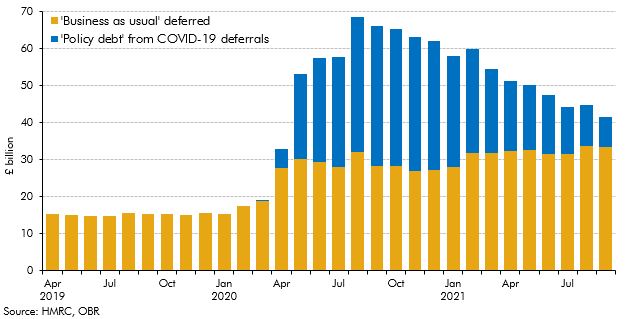

As Chart C shows, total tax debt rose from March 2020 during the first national lockdown. It peaked at £67 billion in August 2020 then began to decline gradually, despite the second and third national lockdowns. At the end of September 2021, HMRC’s tax debt balance had fallen back to £42 billion. This was still more than double the pre-pandemic level, with further payments of deferred VAT expected to continue reducing this balance over the remainder of 2021-22. Compared with January 2020, it is estimated that an additional 2.4 million taxpayers are in tax debt as of September 2021. By contrast, the level of debt write-offs and remissions by HMRC in 2020-21 halved relative to 2019-20, from £4 billion to £2 billion.a This was due to the moratorium on insolvencies and extensive fiscal support measures reducing the number of business failures. To the extent that insolvencies have been delayed rather than avoided altogether, revenue losses from the elevated debt balance could increase as fiscal support ends.

Chart C: HMRC tax debt balance

This box was originally published in Forecast evaluation report – December 2021