One of the key differences between the CPI and RPI inflation measures arises from the formulae used to construct the indices. In the year leading up to our March 2011 forecast, the contribution of this 'formula effect' to the divergence between CPI and RPI inflation had increased. This box explained the possible implications for our long-run assumption about the CPI-RPI wedge and our inflation forecast.

This box is based on ONS inflation data from February 2011 .

The key differences between the CPI and RPI inflation measures arise from the goods and services included in the indices, the representative population they cover and the way in which the indices are constructed. The CPI mostly uses a geometric mean to aggregate price changes, whereas in the RPI an arithmetic mean is used. The former is better-suited to accounting for the effect of substitution between goods and services when relative prices change. The extent to which the results using these approaches differ depends on the variance of price changes in the underlying components of the index.

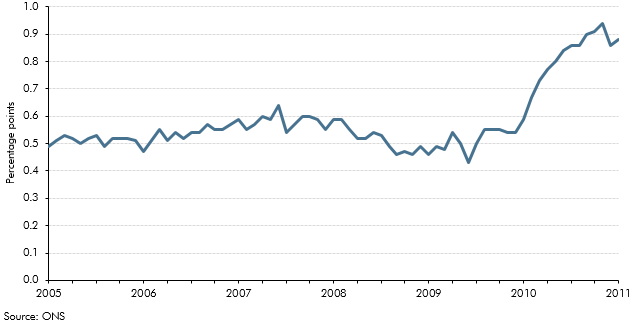

The difference between the CPI and RPI inflation rates, as a result of using different formulae, has risen from around 0.5 percentage points over 2009 to around 0.8 percentage points over 2010, as shown in Chart A.a The ONS has indicated that changes in the way in which prices of clothing are measured, first implemented in January 2010, have the potential to increase the formula effect.b

Chart A: Contribution of the difference between RPI and CPI from the formula effect

We assume that the larger contribution from the formula effect in 2010 will persist, implying a permanent increase in the difference between CPI and RPI inflation of around 0.3 percentage points. Therefore, if mortgage interest payments grow in line with average earnings growth, we might expect the wedge between CPI and RPI inflation to be around 1.2 percentage points in the long run. However, in our central forecast, mortgage interest payments are rising faster than average earnings throughout, so the wedge is a little larger than that implied by our long-run estimate.