An additional rate of income tax of 50p for incomes over £150,000 was introduced in April 2010. Budget 2012 announced that this rate would be reduced to 45p from April 2013. This box explored how incomes were shifted (forestalled) in response to these policy changes

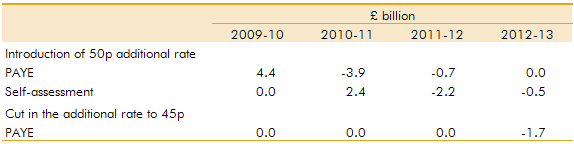

The previous Government announced in Budget 2009 that it would tax incomes above £150,000 at 50 per cent from April 2010. In Budget 2012, the current Government announced that this ‘additional rate’ would be cut to 45p from April 2013. High-income individuals brought forward taxable income (‘forestalled’) into 2009-10 so that it would be taxed at 40 per cent rather than 50 per cent. This boosted the tax take on 2009-10 liabilities but meant a lower tax take in the following two years as this forestalling unwound. Similarly, the cut in the additional rate to 45p led to ‘reverse forestalling’, with high-income individuals shifting taxable income from 2012-13 to 2013-14 to take advantage of the lower rate.

The payment on account regime for self-assessment (SA) means that the effect of forestalling on SA liabilities is not seen in receipts until the following year and SA receipts are scored in the public finances when the cash is received. So the SA forestalling on 2009-10 tax liabilities ahead of the introduction of the 50p rate boosted SA receipts in 2010-11. The unwinding of this forestalling depressed SA receipts particularly in 2011-12 and to a smaller extent in 2012-13.

Table A: Latest estimates of the effect on income tax of forestalling

PAYE forestalling ahead of the introduction of the 50p rate had boosted receipts at the end of 2009-10 and in June 2010 we allowed for some unwinding of this effect during 2010-11, although not to the extent that we now estimate to have taken place. The June 2010 forecast had allowed for around a £1 billion effect on receipts from SA forestalling. As a result, SA receipts were stronger than expected in 2010-11 and then weaker in 2011-12. These errors are scored as fiscal forecasting errors in the June 2010 forecast comparisons. The effect of the cut in the additional rate to 45p is scored as a policy change.

Our March 2012 forecast incorporated revised estimates of the effects on receipts. Our latest estimate is that the shifting of taxable incomes from 2012-13 into 2013-14 decreased PAYE receipts in 2012-13 by around £1.7 billion, compared with the initial estimate of £2.4 billion. This error is scored as a fiscal forecasting error in the March 2012 comparisons.