In our March 2023 Economic and fiscal outlook, we forecast that North Sea oil and gas receipts would rise sharply in the near-term to close to their all-time high in cash terms. This box explored the evolution of receipts since the discovery of North Sea oil and gas.

This box is based on HMRC and North Sea Transition data from February 2023 and February 2023 .

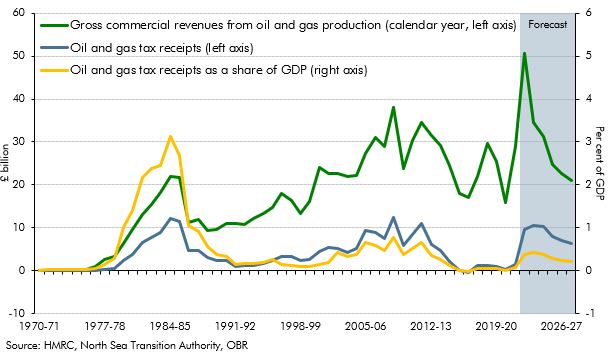

Between 2022-23 and 2027-28, North Sea oil and gas receipts are forecast to average £8.6 billion, up from an average of just £0.8 billion over the six years to 2021-22. They reach close to their all-time high in cash terms in 2023-24.a But while large relative to recent years, relative to the size of the economy these figures remain modest by historical standards.

North Sea exploration started following the Continental Shelf Act 1964. Gas was first discovered in 1965, with production starting the following year.b However, it was not until 1970 that commercial oil was first found and not until 1975 that production began. Since 1975, there have been several dramatic swings in receipts from oil and gas (Chart C):

- Between 1975-76 and 1984-85, receipts increased rapidly reaching a then record high of £12.0 billion (3.1 per cent of GDP). This reflected growth in production, high oil prices, and the introduction, then raising of the rate, of petroleum revenue tax (PRT).

- Between 1984-85 and 1991-92, receipts fell by 91.9 per cent, to £1.0 billion. This reflected a combination of falling oil prices, rising operating and capital expenditure, and the cut in the main rate of corporation tax from 45 to 33 per cent.

- Between 1991-92 and 2008-09, receipts rose more than twelve-fold to a record high in cash terms of £12.4 billion (but only 0.8 per cent of GDP given the larger economy by this stage). This reflected higher oil prices, which boosted sales, and the introduction of the supplementary charge (initially at 10 per cent and later raised to 20 per cent).

- Between 2008-09 and 2021-22, receipts fell by 88.4 per cent to £1.4 billion. This was largely thanks to a fall in the effective tax rate due to a rise in tax-deductible expenditure as well as policy changes. The supplementary charge was reduced to 10 per cent from 2016 and PRT was set permanently to zero in 2016 (but not abolished, in order that losses could be carried back against past PRT payments).

- Between 2021-22 and 2027-28, cash receipts are forecast to rise to £10.6 billion in 2023-24. This is 14.6 per cent shy of the all-time high in cash terms reached in 2008-09 but is only an eighth as high as a share of GDP relative to the peak in 1984-85. This rise reflects a combination of high gas prices – with gas sales expected to exceed oil sales throughout the forecast – and the rise in the effective tax rate following the introduction of the energy profits levy. Receipts then fall back steadily as gas prices ease.

Chart C: Oil and gas receipts and commercial revenues since 1970

This box was originally published in Economic and fiscal outlook – March 2023