In each Economic and fiscal outlook we publish a box that summarises the effects of the Government’s new policy measures on our economy forecast. These include the overall effect of the package of measures and any specific effects of individual measures that we deem to be sufficiently material to have wider indirect effects on the economy. In our March 2024 Economic and fiscal outlook, we adjusted our forecast to account for fiscal loosening and considered the effects of policy to boost employment on our potential output forecast.

This box is based on OBR data from March 2024 .

Our economy forecast accounts for the economic impacts of the latest announced government policies. This includes the demand-side impacts of the package as a whole, calculated using a set of fiscal ‘multipliers’ which are drawn from the empirical literature and reviewed periodically.a These capture wider effects of fiscal policy measures on output over and above their direct effects on government expenditure, through changes to private incomes and spending. The impact of policies on the supply side of the economy is also accounted for if credible evidence suggests that measures will have a material, additional, and durable impact on potential output.

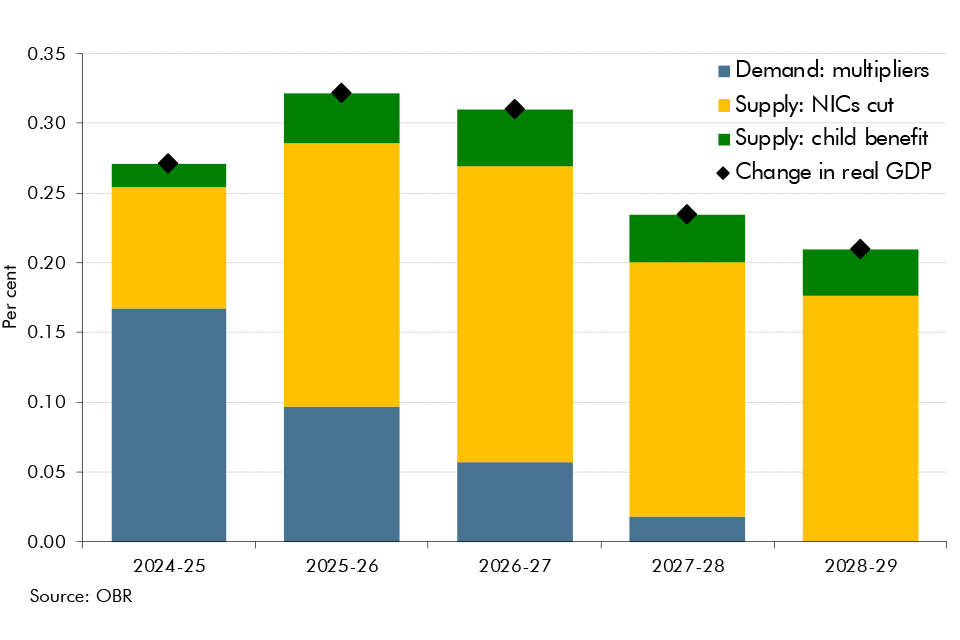

Policies announced in this Spring Budget are estimated to add £14 billion to borrowing in 2024-25, and an average of £8 billion a year from 2025-26. We estimate that these policies raise GDP by an average of 0.3 per cent across the forecast period through their impacts on both the demand and supply sides of the economy (Chart A). The near-term stimulus to demand (blue bars) almost entirely reflects the further permanent cuts to NICs and a temporary fuel duty freeze boosting post-tax real incomes. Two Budget measures are expected to have lasting supply-side effects. The additional cuts to NICs (yellow bars) and changes to the high income child benefit charge (HICBC) (green bars) are estimated to raise GDP by a total 0.1 per cent in 2024-25. The impact rises to 0.2 per cent from 2025-26 onwards as more people adjust their labour supply in response to changes in financial incentives. Box 3.2 sets out a summary of our labour supply modelling.b

Chart A: Impact of policy measures on real GDP

These two Budget measures are estimated to increase labour supply by around 100,000 (in fulltime equivalent (FTE) terms) in the final year of the forecast. This is additional to the roughly 200,000 estimated combined final-year boosts from the NICs, childcare, welfare reform and other measures announced at the last two fiscal events. All of these estimates are highly uncertain and subject to revision. And, as discussed in Box 3.2, the net effect of recent fiscal policy changes on labour supply also needs to take account of the negative effect of the ongoing freeze to personal tax thresholds. As we also discuss in Box 3.2, recent upward revisions to the size of the population have increased our estimates for both the cost and labour supply impact of the Autumn 2023 NICs cut (those revisions are also reflected in the impacts of frozen thresholds). Non-tax measures, in the areas of childcare and welfare reforms, are also subject to delivery risk. The expansion of free childcare from April, which we estimated would boost employment by 60,000, has received additional funding to support delivery.

We expect this Budget’s measures to reduce CPI inflation by 0.2 percentage points in 2024-25, almost entirely reflecting the effect of maintaining the 5p cut to fuel duty for one more year and freezing alcohol duty. Part of this effect unwinds in 2025-26, when the planned increase in fuel duty adds 0.1 percentage points to CPI inflation. The fiscal stimulus raises inflation by a small amount – a cumulative 0.1 percentage points by 2028-29 – which leaves the overall level of CPI broadly unchanged by the end of our forecast horizon. The cut in capital gains tax for properties increases property transactions by around 2 per cent in the near term, before tapering away over the remainder of our forecast.

This box was originally published in Economic and fiscal outlook – March 2024