The coronavirus pandemic has hit the economic and public finances of all countries around the world as a result of lockdown measures imposed to control the outbreak and fiscal support provided to aid individuals and businesses. In this box we assessed how the UK had fared relative to other major advanced economics by looking at pandemic-related indicators and forecasts.

This box is based on BSG and IMF data from March-June and June 2020 .

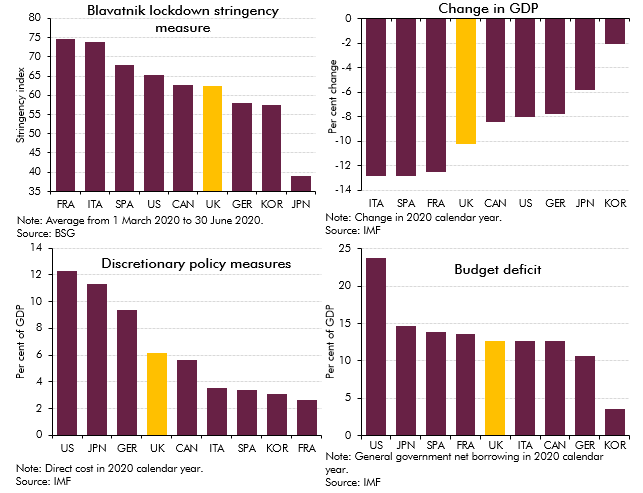

The coronavirus pandemic has hit the economies and public finances of all countries around the world. Lockdown measures have been imposed to control the outbreak and fiscal support has been provided to individuals and businesses. How has the UK fared relative to other major advanced economies? Chart A plots four indicators that tell the high-level story of lockdowns and their consequences in the G7 economies plus Spain and South Korea.

The top-left panel plots the average reading between March and June of the Blavatnik School of Government’s stringency index, which measures the intensity of lockdown policies that restrict people’s activities. On this measure, the lockdown here has been of about average intensity.

Chart A: Pandemic-related indicators and forecasts for selected major economies

The top-right panel plots the IMF’s forecasts for the drop in real GDP in 2020 from its June 2020 World Economic Outlook (WEO). It shows how the depth of a country’s recession is closely correlated with the intensity of its lockdown. The exception to this is South Korea, where the lockdown has been of similar intensity to that in Germany, but a much milder recession is predicted. The IMF expects the UK’s recession to be relatively deep given the intensity of our lockdown, which could be because our economy is so services oriented and these sectors have been more severely affected by lockdown policies and consumers’ responses to them. The depth of the UK recession predicted by the IMF is similar to that in our upside economic scenario.

The bottom-left panel shows the IMF’s estimates of these countries’ ‘above-the-line’ fiscal policy responses (i.e. excluding guarantee-type interventions). There is little correlation between scale of policy response and the depth of the predicted recession. There are several possible explanations for this. First, all else equal, countries with more powerful automatic stabilisers need to rely less on discretionary policy. This seems to be borne out, with the policy response particularly large in the US and Japan, where automatic stabilisers are weaker, and smaller in France, with its relatively generous social safety net. The German policy response is unusually large for a country with more powerful automatic stabilisers. Second, causation runs both ways: the deeper the shock, the greater the need for policy to respond; but also, the larger the policy response, the greater the extent to which the economy will be cushioned from the full force of the shock.

The bottom-right panel shows the IMF’s WEO forecasts for budget deficits this year. This combines the cost of discretionary policy measures with the IMF’s view of the broader fiscal consequences of recessions on public spending and tax revenues. On this measure, the IMF’s predictions for the UK are reasonably in line with other countries facing large recessions. The US stands out on this measure thanks to both the scale of the discretionary policy response there, but also the much higher deficit it was expected to run prior to the pandemic hitting.