Public sector net financial liabilities (PSNFL) is a wider measure of the balance sheet than public sector net debt (PSND) and includes all financial assets and liabilities recognised in the National Accounts. In this box we examined some of these differences and presented a projection of the components of PSNFL.

This box is based on ONS data from October 2018 .

Public sector net financial liabilities (PSNFL) is a wider measure of the balance sheet than public sector net debt (PSND) and includes all financial assets and liabilities recognised in the National Accounts. Sources of differences between the two measures include illiquid financial assets, such as student loans and equity stakes in financial institutions acquired during the financial crisis, which net off against PSNFL but not PSND. Additionally, some liabilities add to PSNFL without affecting PSND, including net pension liabilities for funded pension schemes.

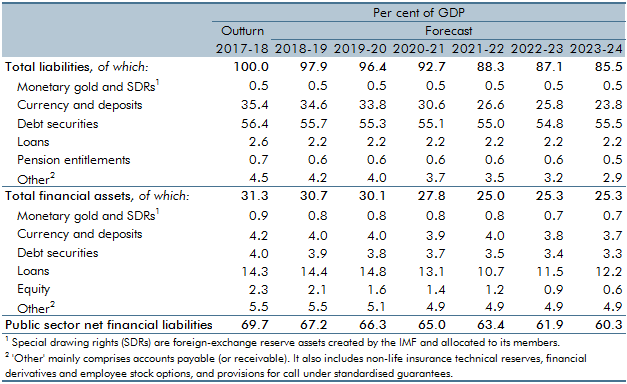

We project PSNFL to fall from 68.7 per cent of GDP in 2017-18 to 60.3 per cent in 2023-24. As Table D shows, this 8.4 per cent of GDP fall reflects a 14.5 per cent of GDP fall in liabilities partly offset by a 5.9 per cent of GDP drop in assets:

- The largest single contribution to both movements arises from loans issued by the Bank of England under the Term Funding Scheme (TFS). We assume that all £127 billion of these loans (5.0 per cent of GDP in 2023-24) redeem over the forecast period. This reduces assets and liabilities in equal measure, as the Bank is assumed to reduce its reserves in response – these are recorded as deposit liabilities.

- The stock of gilts is expected to decline as a share of GDP over the period. This is reflected in PSNFL in the decline in debt securities liabilities. Other liabilities are not expected to change significantly.

- Despite the significant reduction in loan assets caused by running off the TFS, the overall stock of loans is expected to decline by only 2.1 per cent of GDP between 2017-18 and 2023-24. Sales of the mortgage assets in UK Asset Resolution and of student loans reduce loan assets by 1.1 per cent of GDP, but these are offset by the net issuance of new student loans and capitalising of unpaid interest on these loans that together increase loan assets by 5.8 per cent of GDP. The stock of student loans is expected to rise from 5 per cent of GDP in 2017-18 to 9 per cent in 2023‑24. In 2011-12, before the large increase in tuition fee loans took effect, the stock was under 3 per cent of GDP.

- Sales of RBS shares over the forecast reduce the stock of equity assets held by the public sector from 2.3 per of GDP to just 0.6 per cent of GDP by 2023-24.

Table D: Public sector net financial liabilities balance sheet

In Annex C of our November 2016 EFO, we discussed how we project PSNFL. As PSNFL can be regarded as the stock equivalent of PSNB, our projection starts by cumulating PSNB. On top of this it makes adjustments for the valuation of financial assets and liabilities that will affect PSNFL but not PSNB. The most material weakness in our original methodology related to estimates of pension liabilities. The ONS has developed its methodology for estimating the net liabilities of funded pension schemes and has consulted on their recording in the public finances. It expects to announce the result of this consultation in time to record any changes to the public finances in 2019. Until then we are unable to produce meaningful forecasts of these pension liabilities.

This is one of several pieces of ONS work that should help to improve our understanding of the balance sheet and fiscal sustainability. Box 4.3 discusses developments in the recording of student loans that may lead to a more realistic valuation of these loans within PSNFL. The ONS is also planning to introduce debt and deficit statistics consistent with the IMF’s Government Financial Statistics Manual (GFSM). These will include estimates of the assets and liabilities of both funded and unfunded pension schemes (only funded schemes are captured within PSNFL). Finally, the ONS plans to reintroduce measures of public sector non-financial assets in Blue Book 2019, which will enable the production of measures of public sector net worth.

This box was originally published in Economic and fiscal outlook – October 2018