At Budget 2020 we assessed the Government's performance against the three proposed fiscal rules that featured in the Conservative Party's 2019 election manifesto. In this box we assessed whether the Government could meet these fiscal rules under our central, upside and downside scenarios.

At Budget 2020, the Chancellor was guided by three fiscal rules that had featured in the Conservative Party’s 2019 election manifesto: for the current budget to be at least in balance by the third year of the forecast period; for public sector net investment to average no more than 3 per cent of GDP over the five-year forecast period; and to revisit fiscal plans if debt interest exceeds 6 per cent of revenue for a sustained period. Our pre-virus forecast showed all three rules being met, with a tiny margin against the maximum investment rule, a small one against the current budget rule and a large one against the debt-interest-to-revenue ratio rule.

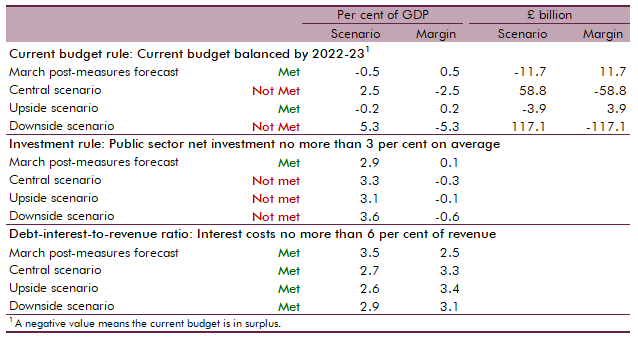

Table A shows how those assessments would differ under our three scenarios. It shows that:

- The current budget rule would be missed in the central and downside scenarios, by margins ranging from 2.5 to 5.3 per cent of GDP. That reflects the hit to cash receipts in 2022-23 and the effect of weaker nominal GDP on the spending-to-GDP ratio. In the upside scenario it would be met by a smaller margin than in our March forecast.

- The maximum investment rule would be missed in all scenarios as the weaker path of nominal GDP raises the ratio of spending to GDP – particularly at the start of the period.

- The debt-interest-to-revenue-ratio rule would be met comfortably in all three scenarios despite higher debt-to-GDP ratios, thanks to much lower effective interest rates. Indeed, the margin by which the rule is met is larger in all three than it was in our March forecast as a result of the very low interest rates that markets expect to persist in the coming years. We look at the risks posed by adverse interest rate movements in Chapter 5.

Table A: Performance against the Budget 2020 fiscal rules