In April 2019, the European Parliament and Council adopted new regulations to set mandatory emissions targets for new cars. Ahead of our March 2020 EFO, the Government told us that all of these provisions transferred into UK law on 31 January 2020 under the terms of the EU Withdrawal Act. In this box we considered the effect of this change on the UK public finances.

In April 2019, the European Parliament and Council adopted new regulations to set mandatory emissions targets for new cars. These targets are being phased in from 2020 and apply in full from 2021. They set an EU-wide fleet emissions target of 95 grams of CO2 per kilometre for new cars. In broad terms, each manufacturer faces a fine of €95 per new car registered for each gram deviation above this target (on a fleet-wide average basis). Each manufacturer will face a separate weight-adjusted target and ‘super credits’ will be issued between 2020 and 2022 for zero and very low emission cars.

We asked the Government whether it will continue to levy these fines from 1 January 2021, after the Brexit transition period ends, as this would represent a new source of income for the Exchequer. It told us that “all of the provisions of the CO2 regulatory regime as it stands, including those relating to the targets and fines for non-compliance” transferred into UK law on 31 January 2020 under the terms of the EU Withdrawal Act. It also told us that the Government has committed to “pursue a future approach that is at least as ambitious as the current arrangements for vehicle emissions regulation” via its ‘Road to Zero’ strategy.a We therefore need to forecast the effect of these fines on the public finances.

The latest Society of Motor Manufacturers and Traders (SMMT) data the average emissions of new cars in the UK in 2019 was 127.9 grams of CO2 per kilometre, around 35 per cent above the current EU-wide 2021 target.b On that basis, hitting that target in 2021 would require falls of around 14 per cent a year in 2020 and 2021 – versus an average over the past ten years of just 2 per cent a year (according to the SMMT). Some policy details have yet to be finalised, for example with respect to ‘pooling’ (whereby manufacturers can group together to meet emissions targets jointly) and any exemptions for smaller manufacturers (which form part of the current EU regime). We have drawn on a range of external estimates of the new regime’s effect at the EU level to generate our own UK forecast for the fines. We also adjust our forecasts for fuel duty and vehicle excise duties (VED) to be consistent with the path for new car efficiencies that results.

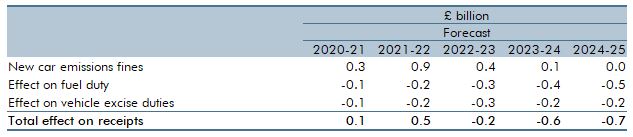

Several external studies have estimated the firm-level impact of these fines at an EU level, with totals varying widely from €2 billion to €34 billion (with some studies looking at 2020 and others at 2021).c,d,e Given the scale of the fines, we have assumed that the average emission rating of new cars in the UK will hit the target only two years late, in 2023, despite the marked change required relative to the trend of the past ten years. This implies an average fall in measured emissions of around 7 per cent a year. This generates a central estimate that these fines will raise £0.9 billion in 2021-22 and diminishing amounts thereafter as car manufacturers meet their targets. In the absence of further policy detail, we assume that the fines will accrue at the point the emissions are reported. As Table A shows, this yield is more than offset by the indirect cost of faster improvements in fuel efficiency reducing fuel duty and VED receipts.

Given the approach we have needed to take to estimate the fines revenue, there is clearly significant uncertainty around these figures. If manufacturers were able to hit the target in 2021, it would reduce overall receipts by around £1.5 billion in 2021-22, relative to our current forecast (reflecting both lower fines revenue and lower fuel duty and VED receipts).

Table A: Impact of new car emission fines

This box was originally published in Economic and fiscal outlook – March 2020