UK GDP had grown less quickly in 2010-11 than the OBR forecast in June 2010. This box decomposed the forecast error by expenditure component and discussed possible explanations, including the external inflation shock.

In this box we consider why UK GDP has grown less quickly since the beginning of last year than the interim OBR forecast in June 2010. The analysis suggests that most of the weakness can be explained by an external inflation shock constraining real household consumption in the year so far.

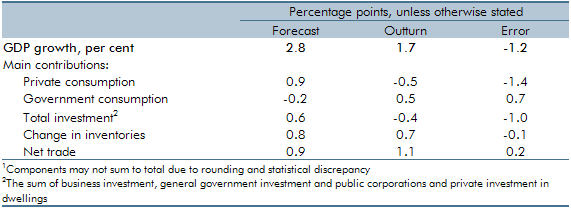

Although provisional GDP data for the third quarter of 2011 is available, we concentrate here on the latest National Statistics data to June 2011. Compared to our June 2010 forecast, the increase in GDP between the first quarter of 2010 and the second quarter of 2011 was 1.2 percentage points lower than expected. This is more than explained by the fact that we overestimated the contribution that private consumption would make to GDP growth by 1.4 percentage points, as shown in Table A.

Table A: Expenditure contributions to GDP growth 2010Q1-2011Q21

The contribution of nominal consumption to money GDP was only 0.1 percentage points lower than forecast, suggesting that higher-than-expected inflation from the second half of 2010 was a key driver of the weakness in real consumption.

This was largely the result of unexpected rises in energy prices and global agricultural commodity prices. Oil prices rose to a peak of $117 a barrel in the second quarter of 2011, against an assumption based on futures prices of just over $80. The IMF commodity food price index rose by around 30 per cent between the first quarter of 2010 and the second quarter of 2011. Overall, CPI inflation was 2 per cent higher than forecast over this period compared to the June 2010 forecast. Crucially, higher inflation was not offset by higher earnings growth and instead squeezed consumer spending.

We slightly underestimated the contribution to growth from net trade. Both exports and imports were higher than forecast, with a larger error in exports, which can be explained by the much stronger-than-expected recovery in world trade flows. The effects of the euro area crisis had not started to bite over this period.

We overestimated the contribution that business investment would make to GDP growth by 1 percentage point. Although credit conditions began to deteriorate after the first quarter of 2011, corporate profits were higher than forecast in 2010. It therefore seems most likely that business investment was scaled back in reaction to the weaker demand outlook from lower private consumption.

We underestimated the contribution to growth from real government consumption. This was largely due to an overestimate of the government deflator, with the contributions of government spending in nominal terms only slightly lower than our forecast. The government deflator is often very volatile and can be subject to large revisions.

To summarise, current data suggest that up to the second quarter of 2011 the fact the economy grew less quickly than the interim OBR forecast in June last year can be explained by the external inflation shock. But this does not exclude the possibility that other factors may have had a role, especially as data on the overall level and the composition of growth over this period is subject to revision in the future.