The July 2015 Budget included a large number of complex welfare measures that cut across multiple benefits with many interactions. At Autumn Statement 2015, we identified a number of measures where interaction effects had not been correctly estimated or classified. In this box of our November 2015 EFO, we discussed the re-estimation and reclassification of the interaction effects of a number of welfare measures. This included the reclassification of three tax credits measures and the measure extending the `lone parent obligation’ to ensure that these costings were consistent with our marginal universal credit (UC) forecast. The impact of cuts to tax credits on housing benefit entitlement were also re-estimated and reallocated to the housing benefit forecast from the tax credits forecast as the effect had previously been incorrectly allocated to tax credits.

An unusually large number of welfare measures announced in the July Budget affected spending across multiple benefits with many interactions. We certified all but one of those measures. While incorporating the changes into our latest forecast, we have identified a number of interactions between benefits that were not estimated correctly. This reflects the challenge of estimating interactions between HMRC tax credits and DWP benefits in the run-up to a fiscal event, where the Treasury’s policy costings process does not permit us to call on the expertise of officials across both departments on all measures that might be subject to interactions. We have also made a large, but neutral, reallocation of spending between tax credits and universal credit (UC) to bring the treatment of the July measures into line with the approach in our baseline forecast.

Reclassification of three tax credits measures

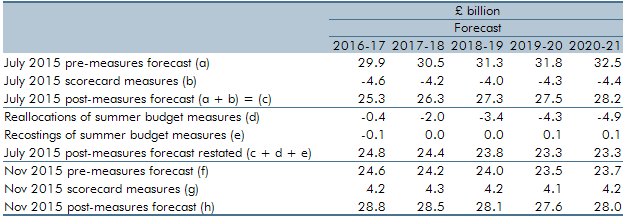

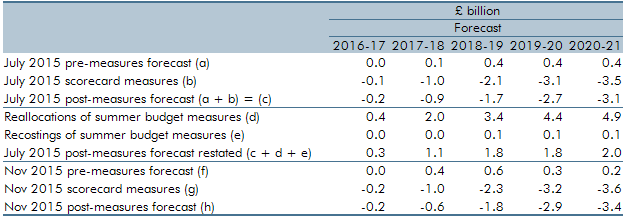

In our July forecast, we took the scorecard costings of the tax credit and UC measures (Tables A and B, line b) and added them to our pre-measures forecast (line a) to reach a post-measures forecast (line c). These costings took a bottom-up approach, whereby the effect on tax credits spending declined over time and the effect on UC increased over time as the UC caseload is assumed to rise (consistent with how the transition to UC will operate in practice). But because DWP is currently unable to produce a full bottom-up forecast of spending on UC and legacy benefits, this is not consistent with our forecast, which is based on adding the marginal cost of UC to a forecast of the legacy tax credits and benefit system.

Correcting this means that the measures are now added into the forecast as though the legacy tax credit system continues indefinitely and only the marginal costs/savings are included in the UC forecast (line d). This results in a further fall in tax credit spending over the forecast period and an equal and offsetting increase to the marginal cost of UC. The net effect on spending is zero. The measures announced in this Autumn Statement, which reverse the main July tax credit cuts, have been costed on a consistent basis with the forecast and are shown in line g of Tables A and B.

Table A: Tax credits: reallocations and recostings

Table B: Marginal cost of universal credit: reallocations and recostings

Interaction between housing benefit and the July tax credit measures

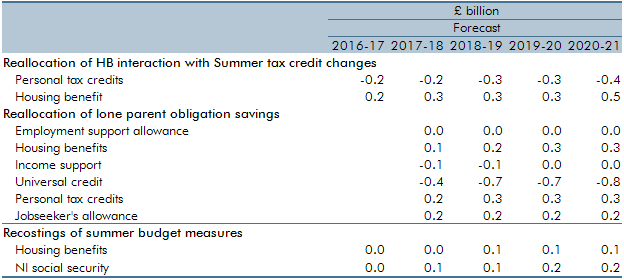

Housing benefit entitlement is based on gross income including any tax credits received. This means that cuts to tax credits will increase the amount of housing benefit families receive. This effect was incorrectly allocated to tax credits – and was also underestimated – in the July costings. Correcting this has reduced tax credits spending and, by a more than offsetting amount, increased spending on housing benefit (Table C).

Reclassification of the extension to the ‘lone parent obligation’ policy costing

The lone parent obligation costing has also been revised to be consistent with the ‘legacy benefits plus marginal cost of UC’ approach in the forecast. That results in spending being moved from UC to tax credits, housing benefit, ESA and jobseeker’s allowance. The net effect on total welfare spending is zero, but £0.5 billion is now outside the welfare cap.

Table C: Other reallocations and recostings

This box was originally published in Economic and fiscal outlook – November 2015