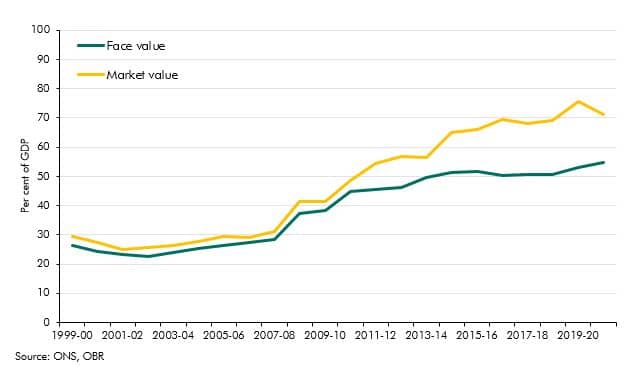

Government debt liabilities can be valued in various ways. In recent years market and face values have diverged sharply reaching 15% of GDP. In this box we explained why this has happened and why we use face value in our analysis.

This box is based on ONS, Public sector finances data from May 2021 .

The National Accounts framework recognises three possible ways of valuing government bonds:

- market value, which represents the amount the Government would have to pay to buy back the stock today;

- face (or redemption) value, which is the amount that the Government has promised to pay to bond holders when the bonds mature; and

- nominal value, which is the original exchange value adjusted for any subsequent payments or accrued interest.

Face or market value are most commonly used. In the past decade these two measures have diverged sharply, with the gap for gilts held by the private sector reaching about 15 per cent of GDP in 2020-21. Some of this has been caused by the increased stock of debt (since a given proportionate difference has increased when expressed as a share of GDP), but mainly it has been driven by declining yields and therefore increasing prices for government debt. This has increased the market value of the existing portfolio, while also affecting the price received for new debt issuance (particularly for index-linked gilts). The DMO prefers to issue new gilts with coupon payments close to market rates (that is close to ‘par’) and where this is possible the face value and market value at the time of issuance will be similar. However, as real interest rates are now negative, index-linked gilts would need to be issued with negative coupons to achieve a par price. This is not practicable and so prices for index-linked gilts are at a significant premium to par.

Chart A: Face versus market value of gilts held by the private sector

The accounting identity that describes the evolution of the debt stock can be written in terms of either of these two debt valuations. The official measure of public sector net debt that we are charged with monitoring is measured at face value, so we use that definition in the analysis in this chapter. An alternative approach is to write the accounting identity in terms of market value, in which case the return on bonds includes not only coupon payments, but also capital gains or losses. This would be more suitable for some other purposes, such as evaluating the value for money of past debt issuance choices (which is beyond our remit). Papers by Hall and Sargent, and Scott and Ellison, provide a fuller discussion of the connection between the two approaches, as well as time series for US and UK government debt under the market value approach.a

This box was originally published in Fiscal risks report – July 2021